S&P 500 Financials Hit Summer Highs Before Earnings

DataTrek’s Nicholas Colas points out that the financial sector is “much more than just banks,” as investors await JPMorgan’s third-quarter earnings report, expected Friday.

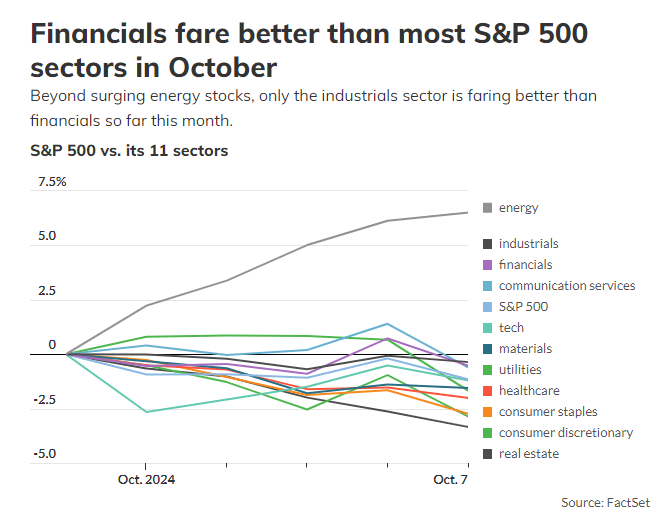

Last week, all three major U.S. stock indexes posted gains for the fourth straight week, driven by a stronger-than-expected jobs report. The financial sector of the S&P 500 rose about 1%, while energy stocks jumped 7% as concerns grew over oil supply risks due to the conflict in the Middle East.

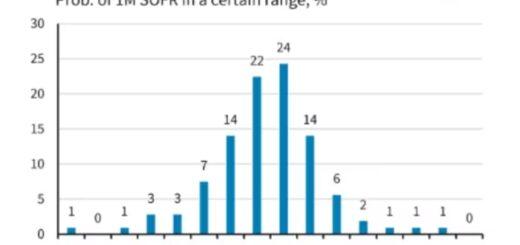

As earnings season begins, investors are closely watching JPMorgan Chase and Wells Fargo, set to release third-quarter results on October 11. According to a DataTrek Research note, the financial sector’s earnings outlook isn’t particularly strong, with analysts forecasting a slight 0.4% decline from last year, primarily due to an expected 12% drop in bank earnings.

However, Colas stresses that the financial sector includes much more than just banks. Non-bank industries, which make up 76% of the sector, are more influential on overall performance. These subsectors include financial services, capital markets, insurance, and consumer finance. The breakdown of weights is as follows:

- Financial services: 32%

- Banks: 24%

- Capital markets: 23%

- Insurance: 17%

- Consumer finance: 4%

DataTrek sees large-cap financials as a diverse way to play continued U.S. economic growth. While early bank earnings can offer some insight, Colas notes that they represent just a small part of the financial sector’s overall story, with non-bank subsectors expected to show year-over-year earnings growth.

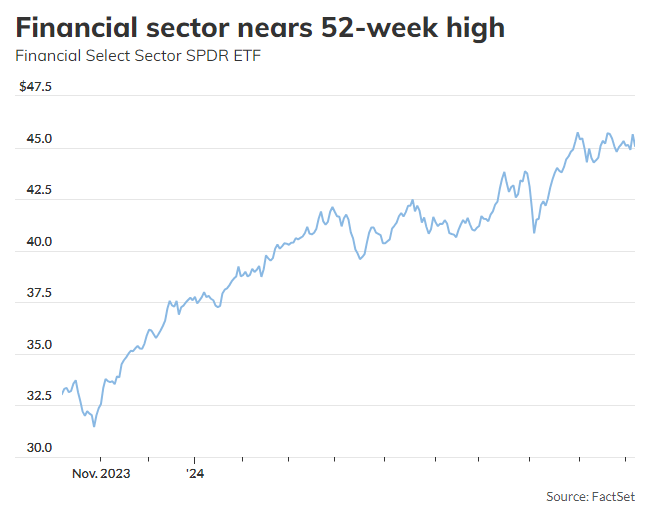

So far in 2024, the U.S. stock market has performed well, with the S&P 500 up 19.4% through Monday, while the financial sector has outpaced it slightly with a 19.8% gain. However, the financial sector has fallen 0.5% in October, while energy has surged 6.5%, reflecting concerns over rising tensions in the Middle East. On Monday, U.S. markets closed lower, with energy being the only S&P 500 sector to end the session in the green.