Inflation-Proof Stocks: One Common Factor

This rise is largely due to stronger-than-expected economic data, including falling unemployment and persistent inflation.

Nearly a quarter of S&P 500 companies now have lower credit-default swap (CDS) spreads than the U.S. government, reflecting shifting market perceptions of risk. As bond trading resumes following the Columbus Day break, the U.S. Treasury market has experienced volatility, with the 10-year yield climbing nearly 50 basis points over the past month.

Political factors may also be at play. Former President Donald Trump has outlined significant tax cuts, which the Tax Foundation estimates could cost up to $6 trillion over the next decade.

Vice President Kamala Harris, on the other hand, has proposed tax-and-spending policies that could amount to $3.5 trillion, according to the Committee for a Responsible Federal Budget.

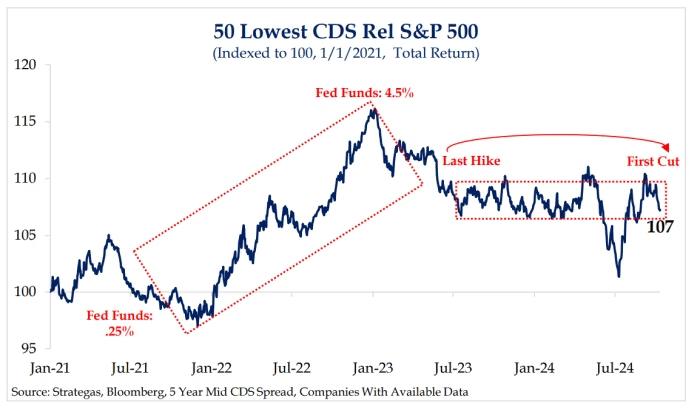

Strategists Jason DeSena Trennert and Ryan Grabinski from Strategas note that 117 S&P 500 companies currently have lower CDS spreads than the U.S. government, indicating a lower perceived risk of default for these corporations. While a U.S. government default would affect all entities, this group of companies is considered a high-quality proxy.

During the inflation surge of 2022 and 2023, the 50 companies with the lowest CDS spreads, including tech leaders like Apple, Microsoft, and Alphabet, outperformed the broader market.

As inflation concerns resurface, this group of stocks could once again attract investors seeking stability in uncertain economic times.