Jobs Data Disrupts Trump-Driven Market Optimism

While political drama, including speculation about Donald Trump’s return to the White House, has dominated recent headlines, financial market are about to face a critical reality check. The November jobs report, set to be released on Friday, could have significant implications for the Federal Reserve’s interest rate strategy, with ripple effects across stocks, bonds, and broader market sentiment.

November Payrolls Could Shape the Fed’s Next Moves

“The market is hoping for good news—but not too good,” said Brent Schutte, Chief Investment Officer at Northwestern Mutual Wealth Management. “If the jobs data is too strong, it could raise doubts about whether the Fed will continue cutting rates.”

Such a scenario would challenge a stock market that’s already trading at historically high valuations. Much of the optimism for a continued rally into 2025 hinges on expectations of Fed rate cuts, which would lower borrowing costs and enhance the appeal of high valuations. Conversely, higher rates tend to reduce the present value of future earnings, putting pressure on elevated prices.

A Look Back at History

Investors wary of the Fed’s impact on markets might recall the dot-com bubble of the late 1990s. Nicholas Colas, co-founder of DataTrek Research, noted that the bubble burst in 2000 after the Fed raised interest rates to 6.5%. “Even a modest series of hikes sent a clear message that the Fed intended to cool the economy, which was enough to dampen investor enthusiasm,” Colas explained.

This time, the situation is different but no less delicate. While DataTrek remains optimistic about equities, parallels to past Fed interventions are a reminder of how sensitive markets can be to changes in monetary policy.

The Fed Walks a Tightrope

Currently, markets are pricing in a 66% chance that the Fed will cut rates by 25 basis points next month, according to the CME FedWatch Tool. This follows cuts in September and earlier this month. However, sticky inflation and resilient economic growth have fueled speculation about whether the Fed might pause its rate-cutting cycle.

Minutes from the Fed’s November meeting revealed a divided outlook among policymakers. Many expressed uncertainty about the neutral rate—the point at which monetary policy is neither restrictive nor stimulative. Steve Blitz, Chief U.S. Economist at TS Lombard, underscored the significance of the jobs report, saying, “The November payroll data could be pivotal for this data-driven Fed.”

Momentum Meets Risk

Despite lingering uncertainty, markets have been riding a wave of momentum. Last week, the S&P 500 notched its 53rd record close of the year, up 26.5% year-to-date. The Dow Jones Industrial Average briefly surpassed the 45,000 mark, while the Nasdaq Composite gained more than 6% in November.

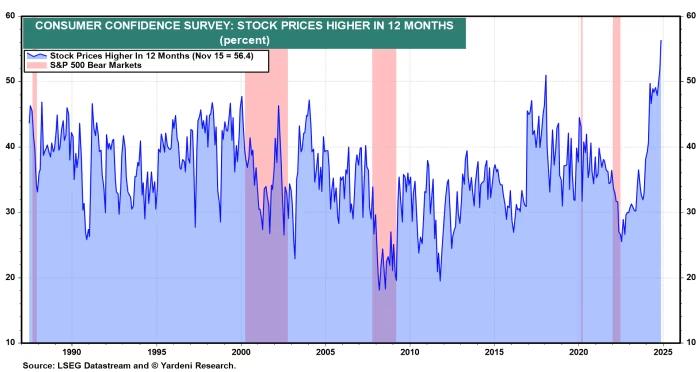

Meanwhile, the 10-year Treasury yield dropped to its lowest level since October, offering some relief to equity investors. However, soaring confidence in future stock gains could signal caution ahead. Economist Ed Yardeni of Yardeni Research observed that consumer confidence in higher stock prices over the next year recently hit an all-time high. “From a contrarian perspective, this suggests a pullback may be on the horizon,” Yardeni warned.

The Bigger Picture

Market moves are often more aligned with economic fundamentals than political shifts. Lauren Goodwin, Chief Market Strategist at New York Life Investments, explained, “Markets respond to real economic changes, not just politics. Durable trends come from broader economic forces.”

While optimism over potential tax cuts and deregulation is buoying sentiment, November’s labor-market data could provide a clearer picture of whether those trends are sustainable. As Paul Christopher of Wells Fargo Investment Institute noted, “The Trump trade aligns with existing economic and inflation trends.”

This week’s jobs report won’t just influence the Fed’s decision-making—it could also shape investor confidence as markets enter the final stretch of the year. Whether the data reinforces the current rally or signals caution, its impact is likely to be significant.