Wall Street’s Confidence: A Dangerous Oversight?

If that were true, it would actually suggest that Wall Street irrational exuberance is fading, a positive sign for contrarian investors. Stock traders are growing more bullish and complacent—and that’s a bearish indicator.

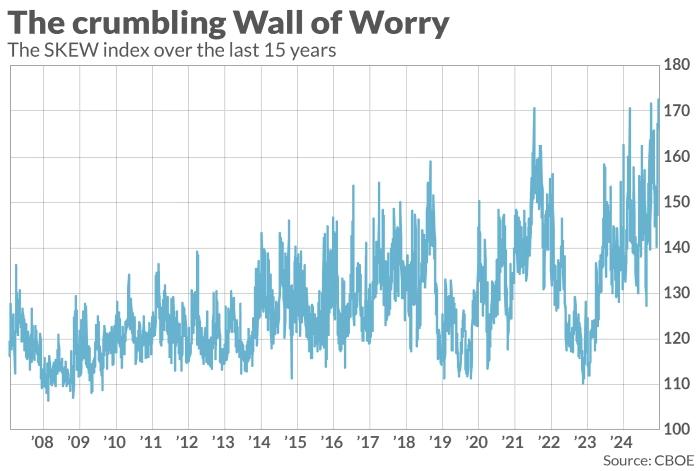

A new concern for the stock market is the CBOE’s SKEW Index reaching an all-time high. Many market analysts are interpreting this as a sign that traders now view a Black Swan event, like a market crash, as more likely. However, this interpretation misses the mark.

In fact, the rising SKEW Index suggests the opposite: traders have become even more bullish, which is a bearish signal from a contrarian viewpoint.

To understand why, let’s first take a look at how the SKEW Index works. While the math behind the index is complex, it essentially measures the difference between the consensus outlook of the majority of traders and the views of a small, highly bearish minority. The index rises when this gap widens.

There are two ways this gap can expand. One is when the bearish minority becomes more pessimistic while the consensus view of the majority of traders remains unchanged. This is the interpretation most commentators suggest when they point to the high SKEW Index as a sign of growing concerns about a market crash.

However, there’s another way for the SKEW to rise: when the bearish minority remains steady, but the majority of traders become even more optimistic. In this scenario, a higher SKEW doesn’t indicate increased fear of a crash—it signals that traders are growing less worried about a downturn.

The implications of these two scenarios are vastly different for investors. There are two main reasons why the current SKEW reading reflects reduced concern about a crash.

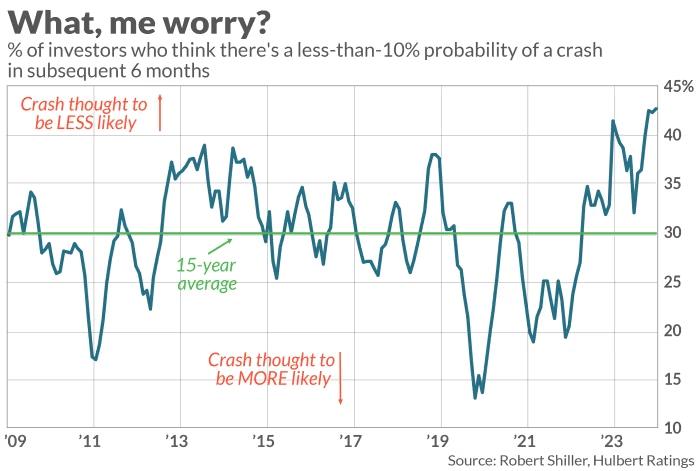

First, the Yale “U.S. Crash Confidence Index,” conducted by Robert Shiller, shows that individual investors are less worried about a crash than they have been in the past 15 years. It would be strange for the SKEW to signal heightened crash fears when other data points, like Shiller’s, suggest the opposite.

Second, the SKEW Index has historically risen in tandem with bull markets. As the market climbs, the consensus among traders becomes more optimistic, increasing the gap between their views and those of the bearish minority. Over the past 15 years, there has been a 56.3% correlation between the SKEW Index and the S&P 500’s trailing 12-month returns, further supporting the link between rising markets and a higher SKEW.

In conclusion, despite some interpretations, Wall Street is not concerned about a market crash. And that’s precisely why we should be worried.