Dollar, Bonds, and the Elusive Market Rally

Treasury Yields and Dollar Levels Present Challenges for Stock Market Recovery

Stocks started the holiday-shortened week on a positive note Monday, but the continued rise in Treasury yields and the U.S. dollar could act as hurdles to sustained equity gains, a prominent market analyst warned.

Both the bond market and the dollar extended their upward trends, reaching levels that could pressure stock-market performance. This follows last Wednesday’s surge, when the Federal Reserve indicated it would implement fewer interest-rate cuts in 2025 than previously expected.

The 10-year Treasury yield climbed to 4.594%, marking its highest close since late May, based on Dow Jones Market Data. Meanwhile, the ICE U.S. Dollar Index (DXY), which measures the dollar against six major currencies, rose 0.4% to 108.09, nearing Friday’s high of 108.54—its strongest level since November 2022.

After a brief pullback last Friday driven by a positive inflation report, both yields and the dollar resumed their climb Monday. Rising yields, which move inversely to bond prices, and a stronger dollar often create headwinds for equities by pressuring corporate valuations and weighing on export-driven profits.

Tom Essaye, founder of Sevens Report Research, described the current levels of the 10-year yield and the dollar as “mild” headwinds but cautioned that their impact could grow if they continue to rise.

Despite these pressures, stocks managed to post gains Monday, albeit in thin preholiday trading. The Dow Jones Industrial Average added nearly 100 points, or 0.2%, while the S&P 500 advanced 0.8%, led by strength in semiconductor stocks. The Nasdaq Composite outperformed with a 1% increase.

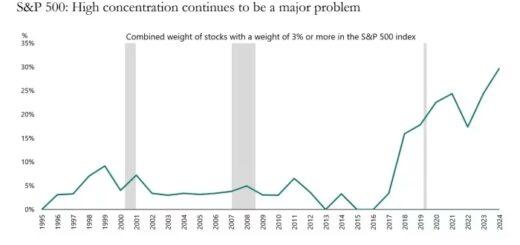

Even with Monday’s gains, major indexes remain down for the month following losses last week. However, the S&P 500 continues to show impressive year-to-date performance, with gains exceeding 25%.

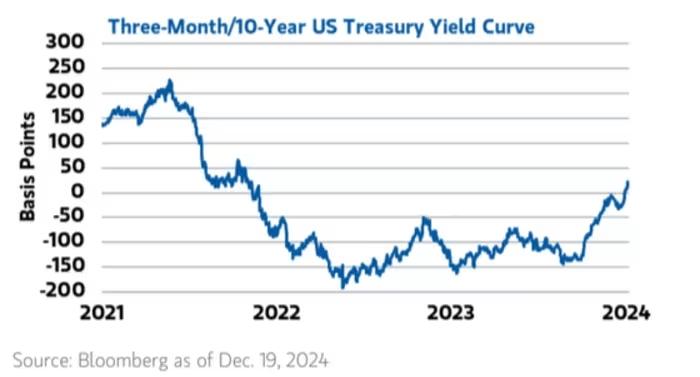

In the bond market, last week saw the yield curve return to its typical upward slope, ending an extended period of inversion. Inverted yield curves, where short-term yields exceed long-term yields, are often seen as recession indicators. Analysts noted, however, that the end of an inversion has historically been a more immediate precursor to economic downturns.

Lisa Shalett, CIO at Morgan Stanley Wealth Management, suggested the yield curve’s normalization signals a shift from disinflationary growth to a reflationary environment. This transition could pose challenges for high-growth stocks, as higher long-term yields reduce the present value of future earnings.

Higher yields and a strong dollar remain obstacles to higher stock valuations, Essaye noted. “Calm currency and bond markets are what stocks need to continue to rally, and we got the opposite last week,” he said. He added that clearer signals from the Federal Reserve or supportive economic data could help stabilize markets and pave the way for further stock market gains.