Will the Santa Rally Boost Stocks?

While 2024 has been a banner year for the S&P 500, December has been an underperformer, defying its historical reputation as one of the strongest months for stocks.

S&P 500 Erases December Losses in Pre-Holiday Surge

The S&P 500 rebounded sharply on Tuesday, erasing its December losses with a 1.1% gain in a shortened pre-holiday trading session. This marked the index’s third consecutive day of advances, reversing last week’s mid-month downturn and setting a positive tone for the start of the seasonal “Santa Claus rally” period.

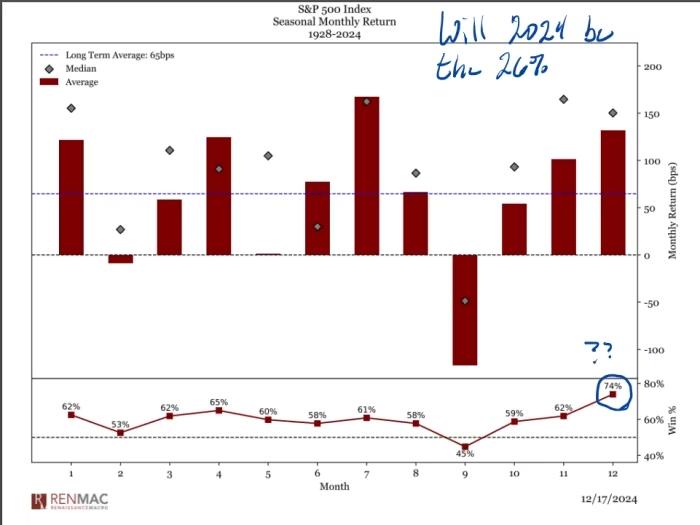

Jeff deGraaf, chairman and head of technical research at Renaissance Macro Research, noted earlier Tuesday that December historically has a 74% chance of delivering positive returns. However, he cautioned that this year’s performance is shaping up to fall within the 26% that bucks the trend unless momentum builds.

The Santa Claus rally, a term coined by Yale Hirsch of the Stock Trader’s Almanac in 1972, refers to a historical pattern where the S&P 500 tends to rise during the final five trading days of December and the first two trading days of the new year. According to historical data, the index has averaged a 1.3% gain during this period, significantly outpacing the typical seven-day average gain of 0.24%.

MarketWatch columnist Mark Hulbert has suggested that the rally persists in part because many investors disengage from active trading during the holidays, allowing the seasonal trend to play out relatively undisturbed.

Tuesday’s rally provided a promising start to this year’s Santa Claus period. The S&P 500 turned its December decline into a 0.2% month-to-date gain. The Dow Jones Industrial Average rose 0.9%, trimming its December loss to 4%, while the Nasdaq Composite jumped 1.3%, extending its monthly gain to 4.2% on the strength of tech stocks.

With markets closing early Tuesday and shutting down entirely on Wednesday for Christmas, investors are keeping an eye on the potential implications of the Santa rally—or its absence. As Jeff Hirsch, editor of the Stock Trader’s Almanac, has pointed out, a lack of a Santa rally has often been a harbinger of flat or bearish markets in the year ahead, as seen in 2000, 2008, and 2015.

Still, 2024 has defied many traditional patterns. Despite the challenges of December, the S&P 500 is on track to post a stellar 26% annual gain, with its steepest pullback of the year—a modest 8.5%—occurring between mid-July and early August.

As the year-end approaches, traders are hopeful that the Santa rally will bring its characteristic boost, helping the market finish an already strong year on an even higher note.