JPMorgan: Market Gains Could Take Longer

The bulls are starting to sweat.

JPMorgan bullish stance has always been measured, and now cracks are beginning to show. After parting ways with Marko Kolanovic due to his unfulfilled bearish forecasts, the bank’s new team, led by Dubravko Lakos-Bujas, set a conservative S&P 500 year-end target of 6,500 — a forecast that sits in the middle of Wall Street projections.

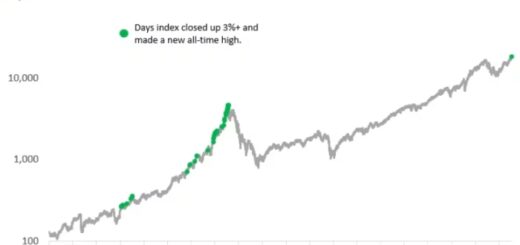

Achieving that target would require a 13% surge from current levels, following Thursday’s 1.8% drop that left the index at 5,738.52.

“We are sticking with our 6,500 target for year-end but acknowledge significant uncertainty, with the possibility that this level may not be reached until 2026,” the strategists noted. They anticipate the index will trade between 5,200 and 6,000 in the near term before rallying later in the year.

Despite recent turbulence, JPMorgan sees minimal recession risk. The strategists believe markets are recalibrating to policy-driven growth concerns, with falling interest rates, oil prices, and a weaker U.S. dollar offering support for risk assets. Lower borrowing costs could unleash pent-up demand in sectors like housing, retail, and autos.

The 10-year Treasury yield has dropped nearly 30 basis points this year, oil prices are down 7%, and the U.S. dollar index has slid 4% in 2025. Markets are pricing in nearly three Federal Reserve rate cuts this year, with the potential for additional cuts if economic conditions deteriorate.

Policy easing would align with the Treasury secretary’s objective to lower rates, stimulate growth without stoking inflation, and narrow the budget deficit. Additionally, a potential Russia-Ukraine peace deal and softer commodity prices could further tame inflation.

Corporate earnings and the labor market remain resilient, bolstering the outlook. Credit markets continue to show strength — a rare signal in the late stages of a business cycle.

Capital spending initiatives in the U.S., defense spending in Europe, economic easing in China, and pro-growth reforms in Japan could further boost earnings. Meanwhile, the AI boom is accelerating, especially in the U.S. and China, with productivity gains likely to provide an underappreciated lift to earnings.

JPMorgan recommends a barbell strategy: defensive stocks like utilities and consumer staples on one side, and rate-sensitive sectors like regional banks and real estate on the other. The bank downgraded large-cap banks to neutral from overweight and upgraded consumer discretionary stocks to neutral from short.

Outside the U.S., Chinese tech and internet stocks present significant upside potential.