Bear vs. Bull: Probing the Persistence of Bearish Sentiments Amidst U.S. Stock-Market Surge

The momentum remains upbeat in the U.S. stock market as we enter the second half of 2023. This has generated optimism among investors, particularly with the technology-focused Nasdaq 100 index experiencing a 42% increase this year. On the other hand, cautious investors closely observe the situation, awaiting the inevitable decline and fading of the current market momentum.

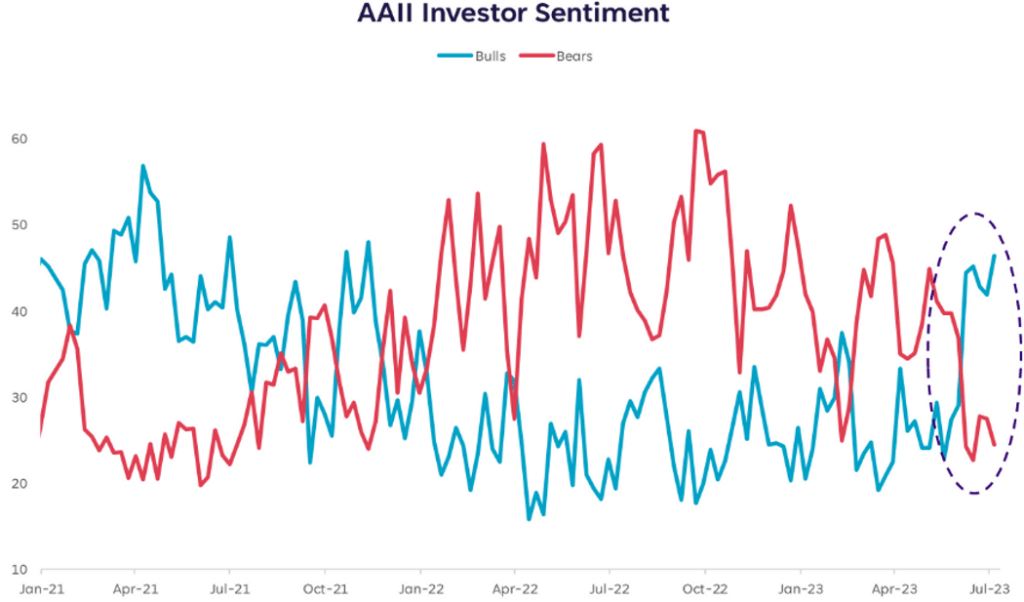

There has been a significant increase in the divide between those who believe that the stock market has the potential to grow (referred to as the bulls) and those who predict a decline (known as the bears).

Liz Young, who leads investment strategy at SoFi, likened the current situation to a political landscape brimming with animosity and resentment between opposing sides, rendering consensus difficult to achieve. This is primarily due to conflicting data, including a stock-market rally that appears disconnected from economic indicators and bond market signals indicating potential problems. Despite these concerns, U.S. stocks continued to climb this week, buoyed by positive inflation readings that raise the likelihood of the Federal Reserve ending its interest rate hikes. There is growing optimism for a gentle economic slowdown, where inflation returns to the central bank’s desired level without a recession. As evidence of this positive sentiment, the S&P 500 hit a new high since April 2022, registering a 2.4% increase for the week, while the Nasdaq Composite rose by 3.2% and the Dow Jones Industrial Average saw a gain of 2.3%.

According to market analysts, the ongoing conflict between the optimistic market participants (bulls) and the pessimistic ones (bears) will persist. They stated that a complete adoption of positive sentiment would not occur until uncertainties regarding monetary policy, economic indicators, and the inversion of Treasury yield curves have been acknowledged and resolved.

Young stated in a later interview on Friday that we might still be implementing stricter measures regarding the country’s monetary policy. Several indicators, such as the yield-curve inversions, indicate that the economy is shrinking, and we have not yet overcome the challenging situation. The conversation about this matter will continue, and Young personally adopts a more careful approach, especially when considering the current valuations.

According to Melissa Brown, who holds the position of applied research managing director at Qontigo, the current anticipation is that markets will move forward. However, there may be occasional obstacles, unless something occurs to cause investors to become negative, similar to the situation experienced for most of the previous year.

The S&P 500 has experienced a 17% increase this year, primarily due to the rising value of prominent tech stocks like Nvidia Corp., Meta Platforms, and Alphabet Inc. This surge in value can be attributed to the growing optimism surrounding artificial intelligence (AI). Nevertheless, there is a potential concern that investors may be overpaying for stocks based on the excitement surrounding AI. If positive outcomes are not observed within the upcoming year, Young suggests that the appeal of these stocks may diminish.

The speaker noted that stocks are typically bought to earn profits over the next year. Although AI may greatly influence different industries, it is unlikely to completely transform the technology world by the end of this year. Hence, the potential problem arises from having unrealistic expectations regarding the timeframe.

Brown from Qontigo also brought up the current lack of stability in the stock market, which has decreased significantly since late March when concerns about the banking sector eased after the unexpected collapse of Silicon Valley Bank. As of Friday, the CBOE Volatility Index VIX stood at 13.31, recently hitting its lowest level over three years. Typically, a VIX score below 20 indicates a perceived low-risk scenario, while a score above 20 indicates an increased period of volatility.

However, Brown explained that her models suggest an increasing difference between a simple model that analyzes market volatility using economic factors and a statistical model that uses data to identify where the volatility occurs.

In a conversation with MarketWatch, Brown stated that for the past six years, possibly even longer, this is the first time the statistical model has predicted a significantly higher level of risk compared to the fundamental model. This suggests that there is hidden or emerging volatility, which can potentially be a threat.

Raheel Siddiqui, a senior researcher at Neuberger Berman, highlighted his worries regarding the forthcoming scarcity of available funds. He pointed out that investors, especially those involved in high-growth mega-cap stocks, are currently excessively invested compared to the amount of liquid assets accessible.

In his Q3 outlook on the stock market, Siddiqui noted that investor enthusiasm tends to diminish when there is reduced availability of funds, which is likely to happen shortly for various reasons. These reasons consist of the Federal Reserve’s desire to decrease its balance sheet through quantitative tightening gradually, the Treasury’s issuance of fresh debt to replenish the Treasury General Account after Congress raised the debt ceiling, and the European Central Bank’s strategy to withdraw €477 billion in TLTRO financing from the banking system.

Siddiqui stated that he believes stocks could experience negative outcomes soon.

According to the latest American Association of Individual Investors (AAII) Sentiment Survey, stock-market optimism declined but is still above average for the sixth straight week. Additionally, neutral and bearish sentiments rose throughout the week until Wednesday.

However, Young from SoFi has mentioned that there has been a significant change in investors’ attitudes from negative to positive. She emphasized that although the chart does not show a large difference between optimists and pessimists, the sudden and dramatic shift in their opinions is noteworthy.

Young suggests that when there are notable and quick shifts, there will often be equally substantial and swift shifts in the opposite direction. This occurs as markets and investors attempt to achieve equilibrium.