Riding the Wave or Facing the Storm? 7 Threats to the Early 2024 Stock Market Momentum

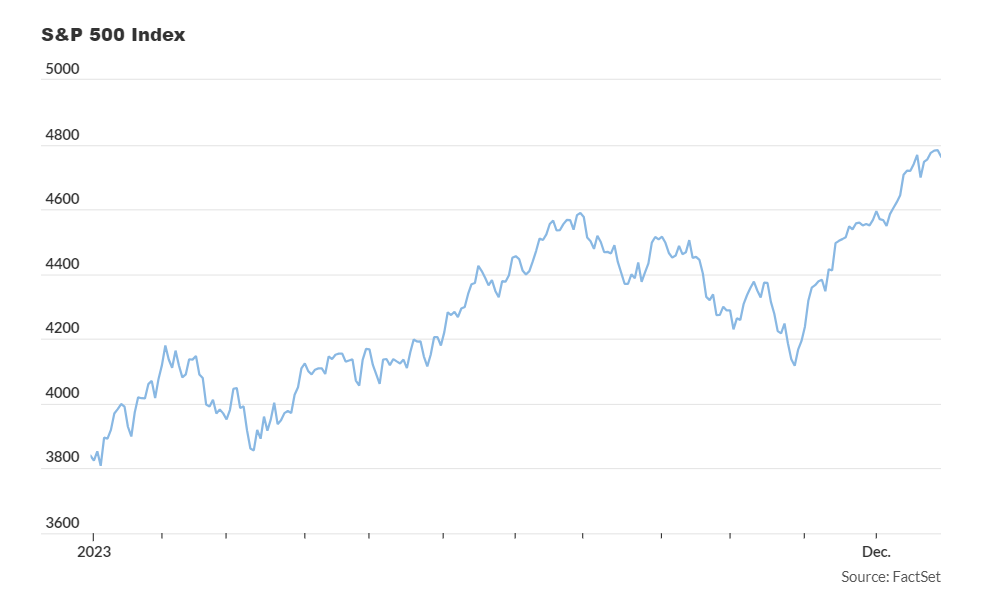

Wall Street analysts are flagging several risks as U.S. stocks conclude a dynamic 2023, marked by record highs in the Dow and the S&P 500. Despite the two-month sprint that propelled the market, concerns are emerging among portfolio managers and strategists about a possible market downturn in January 2024.

Instead of riding the wave of positive momentum, some experts worry that the “January effect” may work in reverse, with investors rushing to secure gains after the S&P 500’s impressive 24% rise in 2023, according to FactSet data.

Various factors are contributing to these concerns, encompassing overbought conditions, a shift from extremely bearish to extremely bullish sentiment, a notably low VIX, and the impending release of an inflation report.

- Overbought Conditions: The widely followed 14-day relative strength index (RSI) on the S&P 500 has been signaling overbought conditions for a month. Although it has slightly pulled back, maintaining an RSI around 70 suggests vulnerability to profit-taking.

- Extreme Bullish Sentiment: The rapid shift from bearish to bullish sentiment in just two months, as indicated by the American Association of Individual Investors’ weekly sentiment survey, raises concerns. Historically, stretched sentiments have often foreshadowed market reversals.

- Low VIX: The Cboe Volatility Index (VIX), serving as a “fear gauge,” dropped below 12 in December, indicating low expected volatility. Some analysts interpret this as a cause for worry, emphasizing the importance of closely monitoring the VIX for potential profit-taking triggers.

- Inflation Concerns: Anxiety is building around the upcoming U.S. inflation report in January, with expectations of core CPI rising over 0.3% in December. The market’s response to inflation might not be as positive as in the past, potentially leading to increased market turbulence.

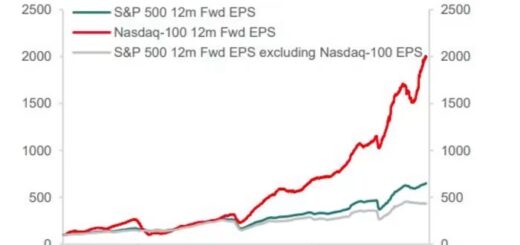

- Earnings Season Uncertainty: While the three-quarter-long “earnings recession” concluded in the third quarter, doubts linger about companies meeting high expectations for 2024. Analysts project an 11.7% increase in S&P 500 aggregate earnings for 2024, raising concerns about potentially excessive optimism.

- Geopolitical and Political Risks: Additional risks emanate from various political and geopolitical events, including Taiwan’s presidential election, U.S. debt-ceiling concerns, the start of the 2024 Republican presidential primaries, and ongoing conflicts in Gaza and Ukraine, posing threats to market stability.

- “Buy the Rumor, Sell the News” Dynamic: Professionals express concern about a potential market downturn following anticipated Federal Reserve interest rate cuts. The belief that investors have already factored in aggressive rate cuts could lead to profit-taking and hinder further market advances unless the central bank surpasses expectations.

In summary, as 2023 concludes on a positive note, analysts urge caution and vigilance in monitoring multiple indicators and events that could impact market dynamics as the calendar turns to January 2024.