Why Small-Cap Stocks Are Beating the S&P 500 Now

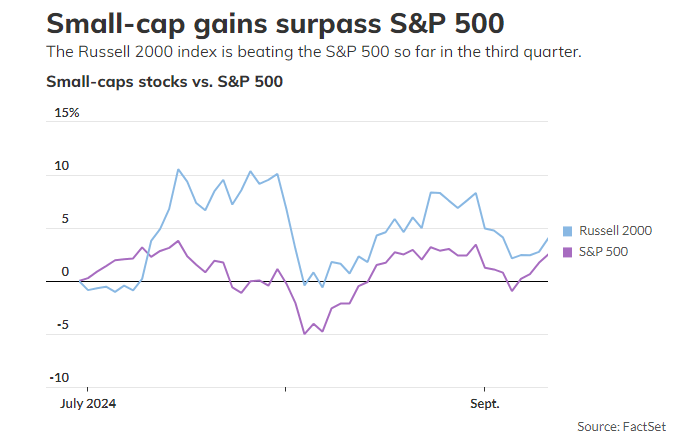

On Thursday, the Russell 2000 index, which focuses on small-cap stocks, saw a strong rise, underscoring the recent outperformance of U.S. small-caps over the S&P 500 in the third quarter. Despite experiencing steeper losses than large-cap stocks in September, small-caps have shown resilience.

“Small-cap stocks got a boost when the Federal Reserve signaled a shift toward easier monetary policy,” said Liz Ann Sonders, chief investment strategist at Charles Schwab, in a Thursday phone interview. This shift became evident at the Jackson Hole Economic Symposium in late August. “Small caps tend to benefit during rate-cutting cycles,” she explained, though the effect is usually stronger when cuts are made in response to a recession.

“But we’re not in a recession,” Sonders pointed out. Despite some economic slowing, “the economy is still performing relatively well,” she added.

The Russell 2000 has risen 4% this quarter, even after a 4% slide in September. By comparison, the S&P 500, which tracks large-cap stocks, has gained 2.5% for the quarter, though it has outpaced small-caps over the course of the year, according to FactSet data.

Investors are looking ahead to the Federal Reserve’s policy meeting next Wednesday, anticipating an announcement of rate cuts. The Fed has kept rates at elevated levels since July 2023 after aggressively hiking them to combat inflation, which peaked in 2022 and has since cooled toward the central bank’s 2% target.

As of Thursday, traders in the federal funds futures market placed a 69% probability that the Fed would lower rates by a quarter percentage point, bringing them to a target range of 5% to 5.25%, based on data from the CME FedWatch Tool. Sonders cautioned that those hoping for larger cuts should “be careful what you wish for,” as deeper cuts tend to occur during recessions or financial crises.

The recent rally in small-caps has lost some momentum after traders adjusted their rate-cut expectations from half a point to a quarter point, triggering profit-taking. Sonders noted that small-cap stocks generally benefit more from lower interest rates than large-cap companies.

She also advised focusing on higher-quality stocks within the small-cap space. “Small-cap stocks aren’t a monolithic group,” Sonders emphasized. There is a wide range of performance across the sector, typically driven by differences in quality. “As the economy slows, investors should seek opportunities in higher-quality small-caps,” she suggested.

The S&P Small Cap 600 index, which applies a profitability filter, tends to consist of higher-quality stocks than the Russell 2000, Sonders noted. She suggested using the S&P 600 as a base when screening for investment ideas.

On Thursday, small-cap stocks outperformed the broader market, with both the Russell 2000 and S&P Small Cap 600 gaining 1.2%, outpacing the S&P 500’s 0.7% increase. U.S. stocks overall rose, with the Dow Jones Industrial Average climbing 0.6% and the Nasdaq Composite advancing 1%.

So far in 2024, the S&P 500 has gained 17.3%, significantly outpacing the Russell 2000’s 5% year-to-date rise, even as both stumbled in September. According to FactSet, the S&P 500 is down 0.9% this month, while the Russell 2000 has fallen 4%.