Why the S&P 500 Trades at Higher Valuations

Nicholas Colas, co-founder of DataTrek Research, notes that substantial changes within the S&P 500 over the last four to eight years have led to its high valuation compared to 2016.

On Election Day 2024, the S&P 500 rose by 1.2%, boosted by gains in Big Tech stocks like Nvidia, Meta, and Tesla, as voters cast their ballots for the next U.S. president.

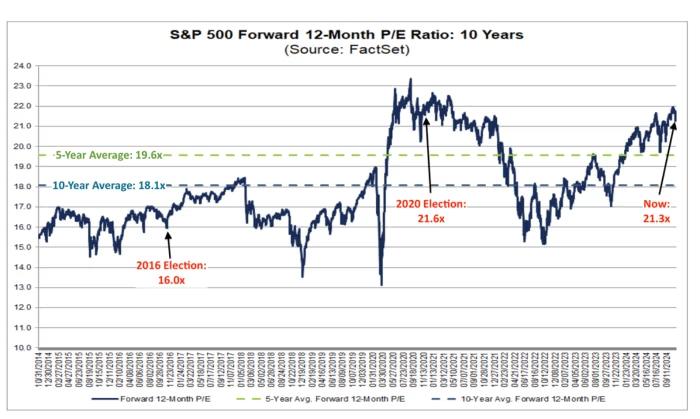

Colas explained that the S&P 500’s price-to-earnings (P/E) ratio has increased significantly since 2016, though it is now closer to 2020 levels. This rise has been driven by shifts in fiscal and monetary policy and a greater weighting of technology stocks in the index.

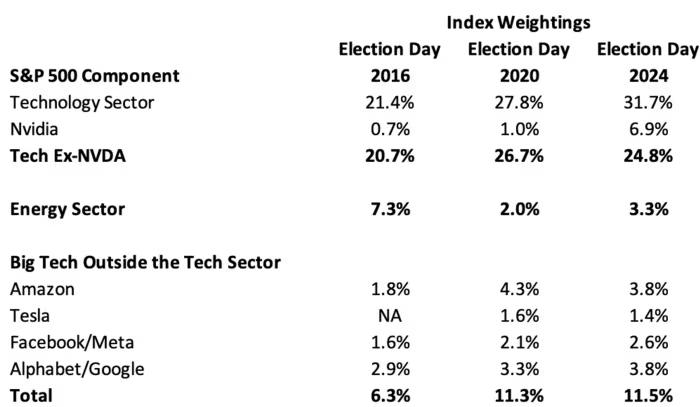

For example, Nvidia’s weighting in the S&P 500 has surged from 0.7% in 2016 to 6.9%, reflecting its position as a leader in AI. The tech sector now represents 31.7% of the index, up from 21.4% eight years ago.

Dominic Rizzo, portfolio manager for the T. Rowe Price Technology ETF, emphasized the critical role that technology and related sectors play in the S&P 500, with Big Tech names like Apple, Microsoft, Amazon, and Meta now accounting for 43.2% of the index, up from 27.7% in 2016.

For investors, this high concentration of tech stocks makes valuation a key consideration. DataTrek’s analysis shows that, despite high interest rates, tech valuations remain strong.

Colas noted that while many expected tech sector valuations to decline in a rising-rate environment, they have instead expanded more than any other sector, with Nvidia trading at 40 times forward earnings, underscoring the ongoing demand for tech-driven growth.