A Look Back: The Growth of a $10,000 S&P 500 Investment Over Two Decades

Outperforming the market is a difficult endeavor only a few people can accomplish.

It is important to mention that it is easier to do better than the stock market when it goes down. In the year 2021, the stock market grew by 29%, but only 15% of money managers did better than the standard. In contrast, the S&P 500 dropped 18% in 2022, and only 51% of money managers did worse than the benchmark. Nevertheless, this achievement rate is not encouraging because more than half of the managers still did worse than the market.

Consider this fact, even if you’re still amazed, that the market is expected to have more gains every year than losses. This means that overall, the market is expected to perform better than any funds that are actively managed.

If you can’t beat them, join them

Warren Buffett, a prosperous investor, advises that most individuals invest in an S&P 500 index fund. This investment method is reliable in generating money over a long period and is easier than finding profitable investments. Even when he is no longer here, Buffett suggests his wife invest only in index funds.

It is easy to determine the value of your current money if you had put $10,000 into an investment twenty years ago.

The sum of the dividends amounts to more than $65,000, leading to a gain of 555%. This computation remains unchanged despite the variations in the stock market and the necessity of moving money between various stocks.

It is possible to choose to invest in this manner while also including various individual stocks in your portfolio, similar to how Berkshire Hathaway is handled by Buffett. Creating a group of approximately 25 thoughtfully selected stocks that are suitably diversified and optionally incorporating an index fund investment offers favorable possibilities for constructing a strong stock portfolio that surpasses the market.

Even if you only invested your money in an index fund, you would still be in a favorable position.

Don’t discount monthly contributions

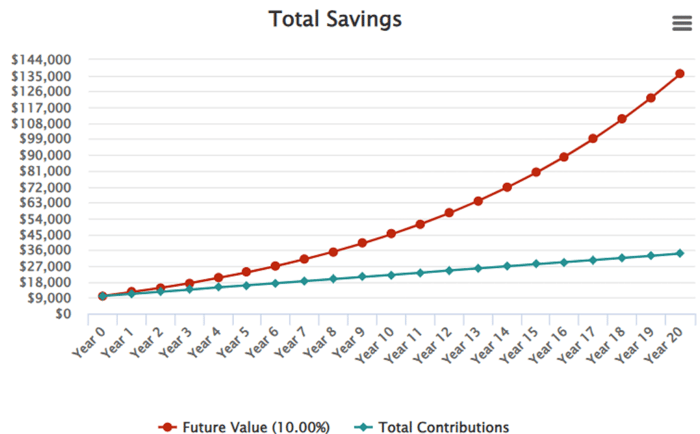

The benefits are even greater at present. If you had made a monthly deposit over the same time frame, your profits would have been significantly greater. Over the past 20 years, the index has typically yielded an annual return of about 10%. If you initially invested $10,000 and added $100 to your account monthly, you would presently have $136,000 in your portfolio.

If you did the math, you would find that $24,000 was contributed over a 20-year span. However, since the funds were not invested for the entire period, the advantages of compound interest have not yet been fully enjoyed.

Investing in the stock market presents several advantages. It allows higher returns than other investment choices, such as bonds or savings accounts. Opting for stocks can also broaden your portfolio and reduce your exposure to risk. Furthermore, by investing in the stock market, you can own a portion of renowned corporations that exhibit growth potential and appreciate value in the long run. In conclusion, if you aim to accumulate wealth and safeguard your financial prospects, investing in the stock market may prove to be a wise decision.

Warren Buffett often communicates his trust in the United States to his investors. Choosing to invest in the stock market is a means of demonstrating confidence in the capabilities of American enterprises.

There are times when the market is affected by unexpected events, which can have either positive or negative outcomes in the short term. These events can be difficult to predict, such as the COVID-19 outbreak, which is considered a prime example of an unforeseeable event. Nevertheless, investing in the stock market can provide access to the long-term growth potential of the United States, which can eventually improve your financial circumstances.

Going through a significant period of inflation at present could strengthen this notion. While there have been instances of extreme inflation in the past, they are rare, and it is plausible that you may not witness one in your lifetime. Nonetheless, putting your money in an S&P 500 index fund can provide security despite any financial challenges and can still result in substantial profits in the long run.