Bull vs. Bear: The Summer Challenge That Could Shape the Stock Market

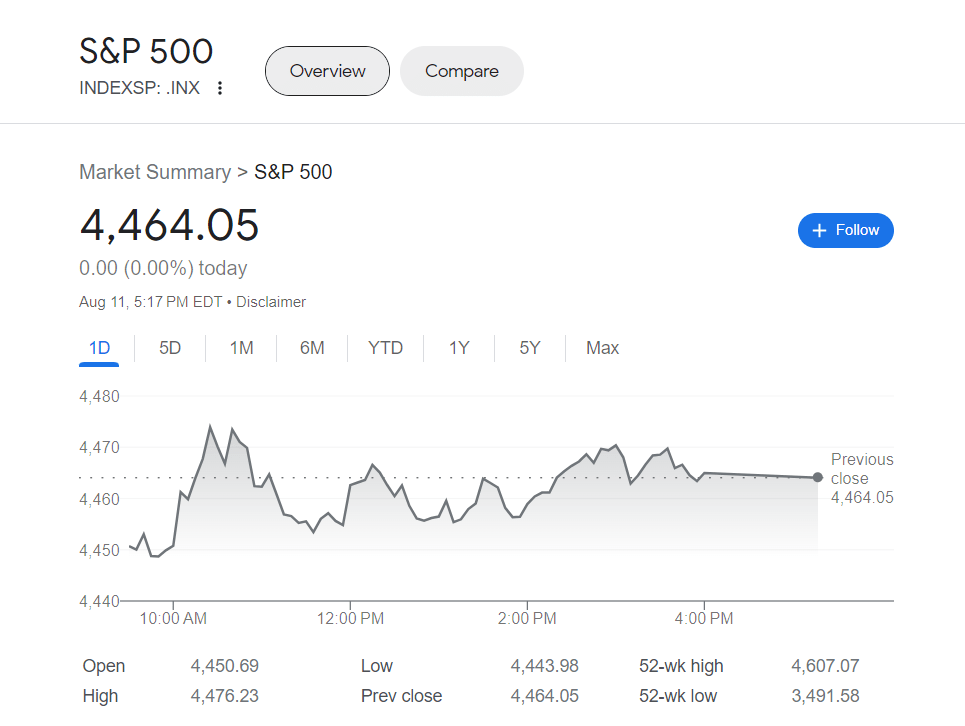

Historical records show that August and September tend to be tumultuous months for the American stock market. Therefore it would not be surprising that there is instability during the beginning of the month. Since the S&P 500 index grew by 20% from January to July 2023 many investors have been hoping that the market would balance out after a sharp rise. As of October 16 the market has increased by 25% since its lowest point after the bear market which occurred on October 12 when it was 3,577.03

What could possibly put an end to the 2023 rally?

Essaye commented in a note last week that if this situation materializes it would significantly weaken the three cornerstones of the rally; as such investors should prepare for a significant drop in stocks regardless of the recent retreat. He continued to mention that in the event of this happening more than 10% reduction can be forecasted thus possibly erasing almost all the enhancement of stocks since June and conceivably all the profits made this year.

That scenario has yet to materialize.

Last week it was reported that the US consumer price index had gone up from 3% in June to 3.2% in July which was higher than the rate from the previous year. On the other hand the core rate (excluding food and fuel prices) had decreased from 4.8% to 4.7% The July producer price index which records wholesale costs was a bit more favorable than anticipated; however investors still think the Federal Reserve will hold the rate when they convene in September.

Policy makers are anticipating to view another collection of employment information such as the August job report and inflation numbers before their upcoming meeting.

At the same time a sharp increase in Treasury yields with the 10-year interest rate surpassing 4.15% after peaking at its highest point since 2023 near 4.2% is causing the stock market to remain weak. This rise in bond yields makes government bonds more attractive than other investments as well as increasing businesses’ expenses when it comes to borrowing money.

The price of stocks has climbed since the end of last year as investors’ fears ended up not being realized however that trend has now come to an end.

The market rally was sparked by a pessimistic environment but the idea that inflation the Federal Reserve and the economy will be in balance — referred to as a “Goldilocks” situation — could spell trouble for those who are overly optimistic according to Hackett. Although these expectations don’t seem too extreme at the moment they still should be monitored closely.

Investors are concerned about the typical patterns seen throughout the year. According to data provided by Dow Jones Market Data the S&P 500 has been relatively inactive in August in comparison to other months in the year since 1928. It has shown a mere increase of 0.67% which ranks August fifth as the worst month for the S&P 500. Meanwhile September stands as the worst with an average decline of 1.1%

And then there’s volatility.

He advised that attempting to be overly shrewd with the market is not ideal since it is likely going through a typical time of stabilization. He declared that it will not continue enduring a prolonged period of hardship.