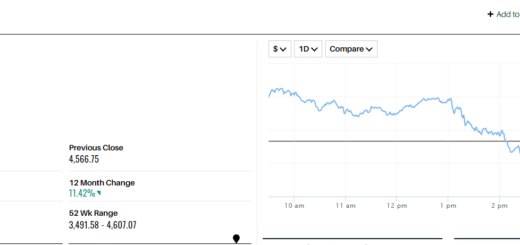

Analyzing the Odds: Will the Stock Market Crash?

The probability of a stock market crash on par with the 1987 event in the upcoming months seems to be significantly exaggerated, even as contrarians find reasons to smile. While the fear of a crash is justified due to the buzz about a potential market bubble, the reality is that the likelihood of a crash similar to 1987 is quite low—just 0.33%.

We can assess the general sentiment through a survey conducted by Robert Shiller of Yale University, where participants indicate the chances of a crash with less than a 10% probability within six months. The latest survey indicates that 33.9% of respondents fall into this category, revealing that 66.1% perceive the risk as higher than 10%. This perception has been on an upward trend, with a rise from 64% in 2015 to 74% today in the 24-month moving average, slightly below last year’s peak of 77%.

The real probabilities have been studied by Xavier Gabaix of Harvard University and researchers from Boston University’s Center for Polymer Studies, revealing a formula predicting crash frequencies. When applying this to the one-day 22.6% decline on Black Monday in 1987, the probability of such an event is 0.33%.

The heightened concerns among investors have roots in the occurrence of two bear markets in rapid succession—early 2020 and 2022. This occurrence is rare and has cast a shadow on long-term investor outlooks. Psychological studies by Camelia Kuhnen from the University of North Carolina underscore how losses trigger more pessimism compared to the optimism generated by gains. This tendency, termed the “pessimism bias,” persists even when markets recover well. Shiller’s crash-confidence index, potentially a contrarian indicator, has shown that higher worries about a crash correlate with better market performance over one-, three-, and five-year periods.

While the crash-confidence index may not predict short-term market moves, its strength lies in forecasting robust market performance over the span of several years.