S&P 500 Futures Step Back after Record-Breaking Momentum

U.S. equity index futures saw a small decrease on Wednesday as traders reviewed the situation following the longest stretch of consecutive gains in the last two years.

How are stock-index futures trading

- The level of the ES00 S&P 500 futures decreased by 5 points or 0.1%, reaching 4391.

- The futures of the Dow Jones Industrial Average, specifically YM00, declined by 19 points or 0.1% to reach 34196.

- The Nasdaq 100 futures, referred to as NQ00, saw a small decline of 30 points or 0.2%, resulting in a final value of 15344.

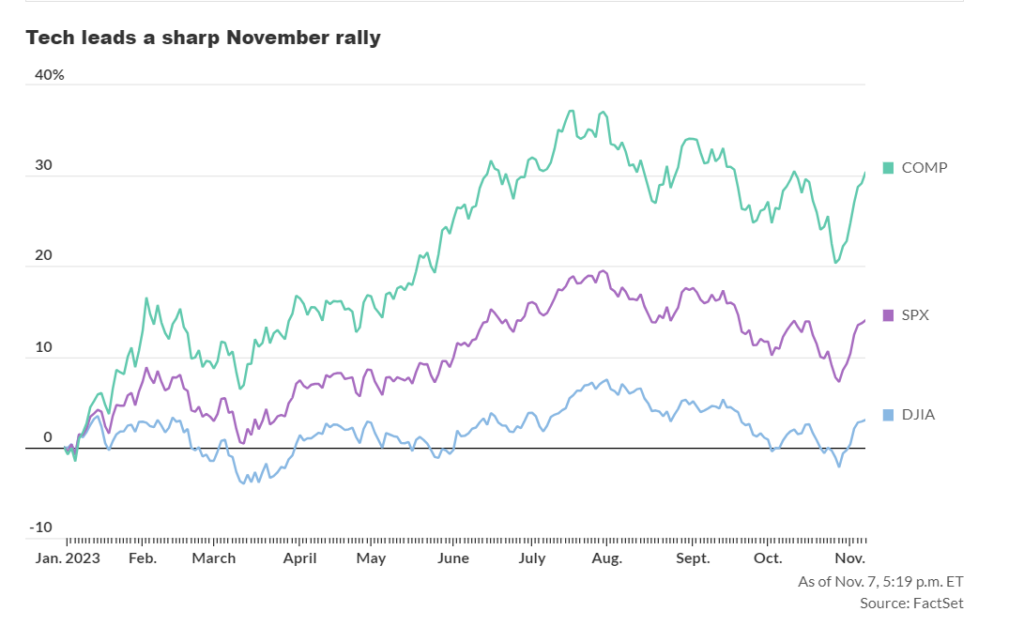

On Tuesday, the Dow Jones Industrial Average rose by 57 points, indicating a 0.17% gain and pushing it to a total of 34153. Similarly, the S&P 500 witnessed growth of 12 points, which translates to a 0.28% increase, resulting in a new figure of 4378. Furthermore, the Nasdaq Composite experienced a gain of 121 points, signifying a 0.9% rise, and reaching a total of 13640.

What’s driving markets

In the last seven trading sessions, the S&P 500 index has seen consistent growth, making it the longest stretch of continuous gains in the past two years. Throughout this time, it has increased in value by 6.3%, with notable contributions from well-known technology stocks. Similarly, the Nasdaq Composite, which is recognized for its extensive presence of tech companies, has also had a winning streak lasting eight days, resulting in an 8.3% rise in value. This performance is the highest it has achieved in the past two years.

After experiencing a notable increase, traders decided to pause, resulting in a small drop in equity index futures.

Derren Nathan, who is in charge of studying stocks at Hargreaves Lansdown, clarifies that the recent decrease in the assumed costs of borrowing and the disappointing employment figures have created a sense of hope for upcoming reductions in interest rates. This sense of positivity has played a significant role in the recent advancements.

Nevertheless, Nathan interjected and expressed his opinion that stocks could experience a pause as investors attempt to handle their expectations amidst potential interest rate reductions and mounting financial strains in the economy. This would not be the first occurrence where the market inaccurately predicted the Federal Reserve’s timing during a period of elevated interest rates.

Tom Lee, the research chief at Fundstrat, justified the need for stocks to undergo a time of consolidation. This is a result of the considerable profits they have recently attained and the lack of any noteworthy macroeconomic updates during this week.

Lee stated that stocks are expected to stay stable if there is no major macroeconomic news, given the unfavorable sentiments of both institutional and retail investors.

Federal officials have a set date to provide their thoughts and opinions on Wednesday. This will involve Chair Jerome Powell, who will kick off the research conference by the Federal Reserve with an introductory statement at 9:15 a.m. Following that, New York Fed President John Williams will deliver the main speech at the same conference at 1:40 p.m. Moreover, Fed Vice Chair for Supervision Michael Barr will address the NAHB conference at 2 p.m. Lastly, Fed Vice Chair Phillip Jefferson will bring the research conference to a close by delivering the concluding remarks at 4:45 p.m.

On Thursday, Powell’s speech is set to be closely observed.

This Wednesday, Roblox, Warner Bros. Discovery, and Under Armour, among other companies, will disclose their earnings before the stock market opens. Later in the day, Walt Disney, AMC Entertainment, and Twilio will report their earnings after the market closes.

Updates on the U.S. economy, including the wholesale inventories for September, will be announced on Wednesday at 10 a.m. Eastern time.

Companies in focus

- Rivian Automotive Inc. saw a rise of 7% in premarket trading as the company reported a decrease in its quarterly loss and revealed that it had ended its exclusive partnership with Amazon.com Inc. regarding their electric delivery vans used for last-mile delivery.

- The stocks of Robinhood Markets Inc. dropped by 7% after the well-known trading app revealed its quarterly earnings, which were below expectations.

- Ebay Inc.’s stock experienced a 7% decline after the company issued a cautious forecast for its upcoming holiday season revenues. This decrease was attributed to the intensifying competition from Amazon.com Inc. and other rivals.