Don’t Miss the Train: A Guide to Capitalizing on the Stock Market Rally

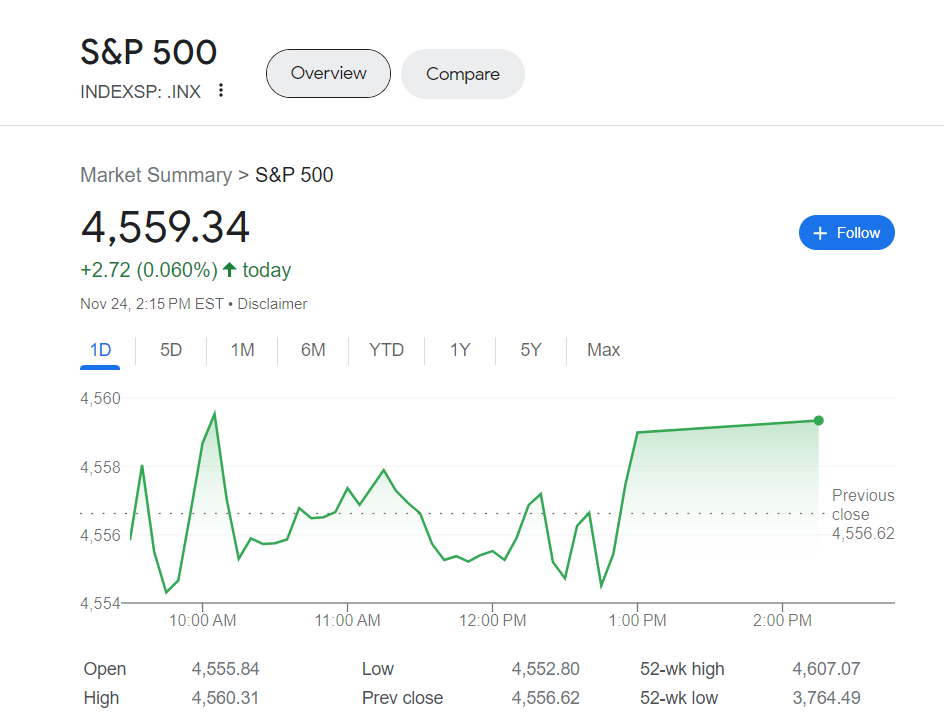

The S&P 500 Index has convincingly broken through the 4400 mark and is maintaining its upward momentum. Despite some signs of an overbought market, there haven’t been any confirmed sell signals yet. Having overcome two minor resistance levels, the next target is the 2023 highs around 4610, and the possibility of reaching the all-time highs at 4800.

There’s an evident gap on the SPX chart down to 4420 that could be filled, but even if that occurs, the overall bullish scenario would remain intact. The key is for SPX to stay above 4400 to sustain the bullish trend.

The recent McMillan Volatility Band (MVB) buy signal reached its goal at the +4σ “modified Bollinger Band” (mBB) and was successfully closed. Now, with SPX above the +4σ Band, there’s a potential setup for a new MVB sell signal. This would begin with a “classic” mBB sell signal, triggered if SPX closes below the +3σ Band, currently at 4488.

Equity-only put-call ratios continue to signal buying opportunities as both are on a declining trend. Despite some distortion from equity put arbitrage, especially on the CBOE, these ratios remain reliable indicators and are expected to stay on buy signals for stocks unless there’s a shift in their upward trajectory.

Market breadth experienced a momentary weakness a week ago when breadth oscillators briefly signaled a sell, but they have since recovered. As of Nov. 24, they are back on buy signals and are moderately overbought. While breadth signals have been somewhat unreliable recently, they are considered in the broader context of trading decisions.

New Highs and New Lows on the NYSE continue to number less than 100, keeping this indicator in neutral territory.

VIX has shown a slight decrease, lingering near 13.0, maintaining the integrity of both the “spike peak” and the overall trend of VIX buy signals. The “spike peak” signal is set to expire on its own, with the trading system recommending an exit on Nov. 24. The trend of VIX buy signals would only be disrupted if VIX closes above its 200-day moving average.

The overall construct of volatility derivatives paints a strongly bullish outlook for stocks, supported by upward-sloping term structures and significant premiums of VIX futures over VIX.

In summary, the current strategy involves maintaining a “core” bullish position as long as SPX remains above 4400, with other trades executed based on confirmed signals within this framework. The market outlook remains positive, with a focus on potential signals that may influence trading decisions.