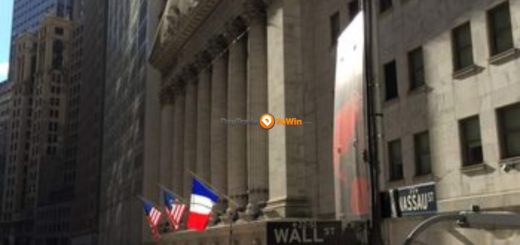

November Triumph: Dow Soars, Wrapping Up the Month with Impressive Gains

- The Dow witnessed a notable increase of more than 500 points on Thursday, reaching its highest level of the year.

- US stocks ended the month of November with substantial gains, resulting in a positive outcome.

- The warnings from Fed officials about additional tightening caused the 10-year Treasury yield to rise by over 9 basis points.

- The Dow Jones Industrial Average hit a peak this year on Thursday, signifying a substantial increase as American stocks wrapped up a month of notable growth.

During November, there was a substantial rise in the Dow and S&P 500 of around 9%, while the Nasdaq saw an impressive surge of 10.7%. This increase can be partly credited to the notable decline in bond yields observed in recent weeks.

Nevertheless, the 10-year Treasury yield saw a notable surge of over 9 basis points on Thursday due to specific Federal Reserve officials expressing apprehensions about the potential for interest rate hikes.

John Williams, the President of the Federal Reserve Bank of New York, expressed the possibility of needing to take additional measures to tighten policies if there is a prolonged period of price pressures and imbalances that exceed his expectations.

Although the personal consumption expenditures index shows a continuous decline in inflation and an increase in weekly unemployment claims indicates more job opportunities, it is still true that…

According to Comerica Bank’s Chief Economist, Bill Adams, the Federal Reserve is presently maintaining its existing policies but is slowly moving towards enacting reductions in interest rates. This adjustment is becoming increasingly likely due to a noticeable decline in inflation and a faster-than-expected deterioration of the job market.

You can rephrase the paragraph as: These values represent the final prices of US indexes as of 4:00 p.m. ET on Thursday.

- S&P 500: 4,567.77, up 0.38%

- The value of the Dow Jones Industrial Average increased by 520.47 points or 1.47% to reach 35,950.89.

- Nasdaq Composite: 14,226.22, down 0.23%

- Here’s what else happened today:

- The economy is displaying a worrisome sign that was last seen prior to the 2008 recession.

- Goldman Sachs anticipates that potential disturbances in oil supply may result in the resurgence of oil prices escalating to $100 per barrel.

- FTX intends to sell assets totaling $744 million in order to repay its outstanding debts to creditors.

- Zillow has made six significant forecasts about the housing market for the year 2024.

- The US election could create uncertainty that may impact the value of the Japanese yen.

- In commodities, bonds and crypto:

- The cost of West Texas Intermediate crude oil dropped by 3.4% to $76.08 per barrel. At the same time, Brent crude oil, commonly used as a global standard, also saw a decrease of 2.7% and reached $82.85 in price.

- The cost of gold went down by half a percent to $2,034.98 per ounce.

- The interest rate on the 10-year Treasury rose by 9.4 basis points, reaching 4.367%.

- Bitcoin fell 0.22% to $37,734. (Source: Yahoo! Finance)