S&P 500’s Struggle: Fourth Consecutive Day of Declines in 2024

The technology stocks index has experienced a decline for the fifth day in a row, making it the longest period of consistent losses since October 2022.

Thursday saw a decline in the majority of U.S. stocks, with the Nasdaq Composite, mainly comprised of technology stocks, experiencing its fifth consecutive drop, while the S&P 500 recorded its fourth day of losses. This downturn can be attributed to the release of labor-market data, which raised concerns about the Federal Reserve’s future monetary policy tightening in 2024.

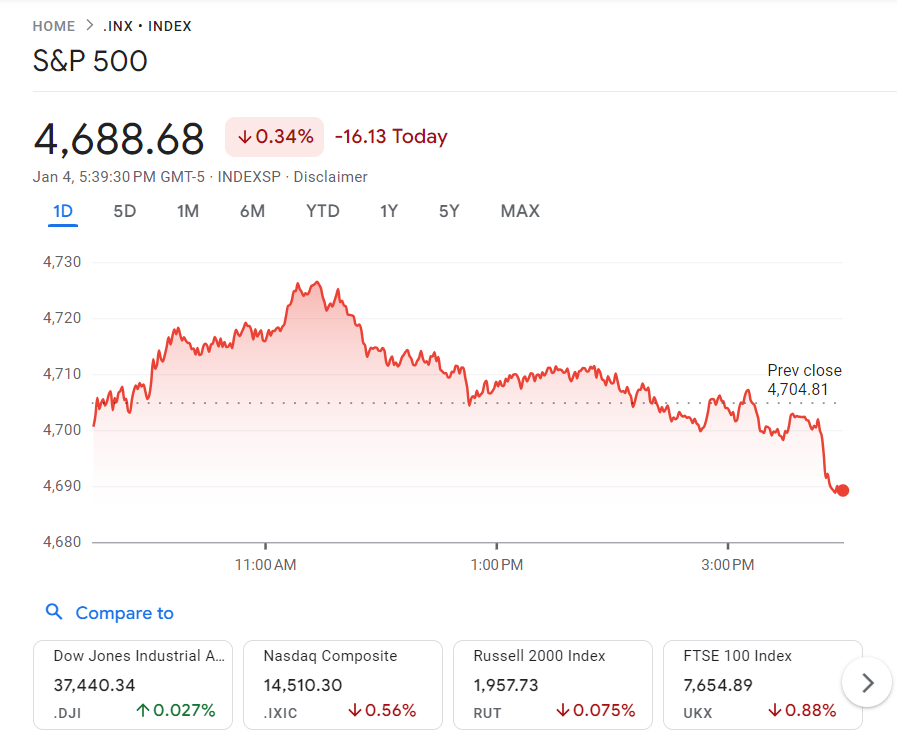

How stocks traded

- Based on information from Dow Jones Market Data, the S&P 500 SPX index fell by 16.13 points or 0.3%, finishing at 4,688.68. This represents the fourth consecutive day that the prominent benchmark index for large-cap stocks has decreased, which is the longest period of declining in more than two months.

- There was a slight change in the Dow Jones Industrial Average DJIA, with an increase of 10.15 points, bringing it to a value of 37,440.34.

- The Nasdaq Composite, a technology-focused index, experienced its fifth consecutive day of losses on Thursday. The index dropped by 0.6%, losing 81.91 points and closing at a value of 14,510.30. This decline is the longest the index has seen since October 12, 2022.

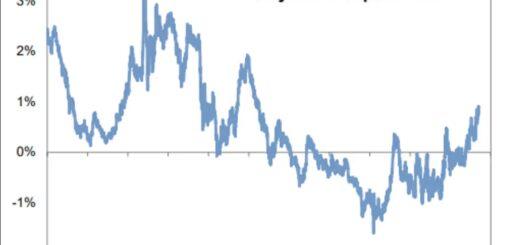

In the early days of 2024, stocks in the United States faced ongoing challenges, leading to the S&P 500 recording its third consecutive decline. The notable stock market index fell by around 1% during the ‘Santa Claus rally,’ a period that spans from late December to early January. This drop represents the most unfavorable performance seen since early 2016.

What drove markets

The year 2023 concluded on a positive note for U.S. stocks as they recorded nine consecutive weeks of gains. However, they faced difficulties at the beginning of the new year. Nevertheless, the Dow industrials managed to achieve a small rise on Thursday, aiding in the recovery from earlier losses in the week.

According to data from Dow Jones Market Data, the Nasdaq Composite experienced its longest streak of consecutive losses in over a year, despite briefly showing some improvement during the morning session.

The selling of assets has been linked to growing tensions in the Middle East, worries about stocks and bonds being excessively bought, and unease that the Federal Reserve might not decrease borrowing expenses as expected.

To put it differently, the released minutes of the Federal Reserve’s December meeting disclosed that officials were satisfied with the decline in inflation. Nonetheless, they also conveyed reservations and uncertainties regarding the plan of action for monetary policy in 2024.

James St. Aubin, the chief investment officer at Sierra Mutual Funds, dismissed the notion that the minutes exerted a substantial impact on how investors perceived the Federal Reserve. He stated that there was nothing in the minutes that changed the market’s perspective.

Most financial markets expect the central bank to lower interest rates by 0.25% five to seven times this year, which is more than the three rate cuts that policymakers suggested last month.

Based on the CME FedWatch Tool, on Thursday, traders who deal in fed-funds futures estimated that there is a 93.3% chance that the Federal Reserve will maintain its benchmark interest rate at 5.25% to 5.5% during its upcoming meeting on Jan. 30-31. Furthermore, the likelihood of a rate reduction of at least 25 basis points by March decreased from 90.3% a week ago to 62.1%.

In English, Brad Conger, who is the deputy chief investment officer at Hirtle Callaghan & Co, described the Fed’s expected interest-rate reductions as being careful. He mentioned that while the market predicted as many as seven cuts by 2024, a more reasonable estimate would be five or six, considering the strong economic data showing a decrease in inflation over the past few months. Conger expressed this viewpoint to MarketWatch on Thursday.

According to Conger, he thinks the market’s expectations of the Federal Reserve rate cuts are not exaggerated.

St. Aubin hypothesized that the sell-off might be motivated by tax considerations. He clarified that there does not appear to be any particular justification for it, other than the possibility that it is a typical period for individuals to sell their investments after the start of the year for tax-related reasons.

It appears that there will be a lot of news in the upcoming weeks that could greatly affect the market. This includes the start of the earnings-reporting period for the final quarter of 2023.

Nevertheless, currently the primary issue at hand is the labor market in the United States because the government is scheduled to disclose the nonfarm payrolls report on Friday at 8 a.m. Eastern time.

This week, investors were given labor-market information. On Thursday, the private-payrolls data from ADP showed that American businesses added an impressive 164,000 new jobs in December. Concurrently, the U.S. government’s data indicated a significant decrease in the number of people filing for unemployment benefits in the final week of 2023, dropping to 202,000 and hitting its lowest point in nearly three months.

In the latest report from November, it was found that the number of job opportunities had fallen to its lowest level in 32 months, with a total of 8.8 million available.

Companies in focus

- On Thursday, Mobileye Global Inc. faced a steep drop of 24.6% as the company behind autonomous driving technology issued a warning regarding their revenue. Additionally, the Israel-based company was downgraded to an underperform rating by Bank of America.

- After releasing its first-quarter earnings, Walgreens Boots Alliance saw a decline of 5.1% in its stock value. Despite the earnings surpassing expectations, the drugstore chain opted to decrease its quarterly dividend by 48%.

- After being downgraded by Wall Street, Apple Inc‘s stocks saw a decrease of 1.3%. Piper Sandler, a financial company, adjusted its assessment of the tech giant from overweight to neutral, citing concerns about its value and the obstacles faced in the smartphone sector.