S&P 500 Futures Skyrocket on the Wings of Netflix’s Phenomenal Results

On the dawn of Wednesday, stock index futures signaled a positive trajectory for the S&P 500, poised to set another record, driven by encouraging earnings, stabilized bond markets, and a monetary boost in China that invigorated risk appetite.

Current futures trading depicts the following:

- S&P 500 futures (ES00) gained 22 points, or 0.4%, reaching 4917.

- Dow Jones Industrial Average futures (YM00) rose 63 points, or 0.2%, reaching 38152.

- Nasdaq-100 futures (NQ00) climbed 132 points, or 0.7%, reaching 17663.

In the prior session, the Dow Jones Industrial Average saw a modest decline of 96 points (0.25% to 37905), while the S&P 500 edged up by 14 points (0.29% to 4865), and the Nasdaq Composite registered a gain of 66 points (0.43% to 15426).

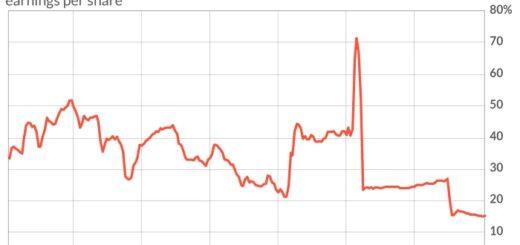

The impetus for market momentum stems from the tech sector, notably highlighted by a premarket surge of 10% in Netflix (NFLX) following robust results, setting a positive tone for the tech earnings season. Kathleen Brooks, research director at XTB, emphasized Netflix’s role as a bellwether for the tech sector and U.S. consumer health, even though it isn’t among the “Magnificent 7.”

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, echoed the sentiment, expressing confidence in promising trends in consumer-led earnings.

As the S&P 500 reaches new peaks, investor attention is keenly focused on the reception of earnings and forecasts from major companies. Ipek Ozkardeskaya, senior analyst at Swissquote Bank, anticipates that robust Netflix results will have a positive ripple effect on major U.S. indices.

Key corporate reports scheduled for Wednesday include AT&T (T), Abbott Laboratories (ABT), and Freeport-McMoRan (FCX) before the market opens. Tech heavyweights such as Tesla (TSLA), IBM (IBM), and Lam Research (LRCX) are set to report after the market closes.

The chip sector may experience a lift from positive results by ASML (ASML), a Dutch semiconductor lithography systems manufacturer, with shares rising by 5% in European trading.

Broader market support is evident in Treasuries, where the 10-year yield remains around 4.1%, signaling increased investor comfort with inflation, growth, and the Federal Reserve’s policy trajectory.

Potential catalysts for the bond market on Wednesday include the release of S&P flash U.S. services and manufacturing PMI reports at 9:45 a.m. Eastern and the Treasury’s auction of $61 billion of 5-year notes at 1 p.m.

Global risk appetite received a boost in late Asian trading following an announcement by China’s central bank about enhancing liquidity by reducing reserve requirements, leading to a second day of sharp gains for Chinese equities.