Goldman Sachs Raises S&P 500 Target to 5,200: Big Tech Takes the Lead

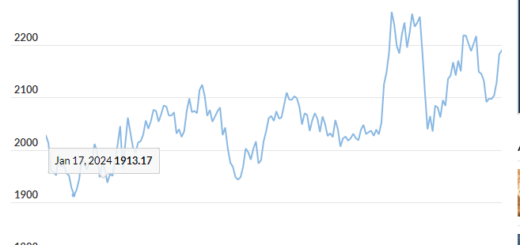

Goldman Sachs has raised its year-end S&P 500 target to 5,200 ahead of Nvidia Corp.’s pivotal earnings this week. The forecast largely relies on the sustained profitability of Big Tech.

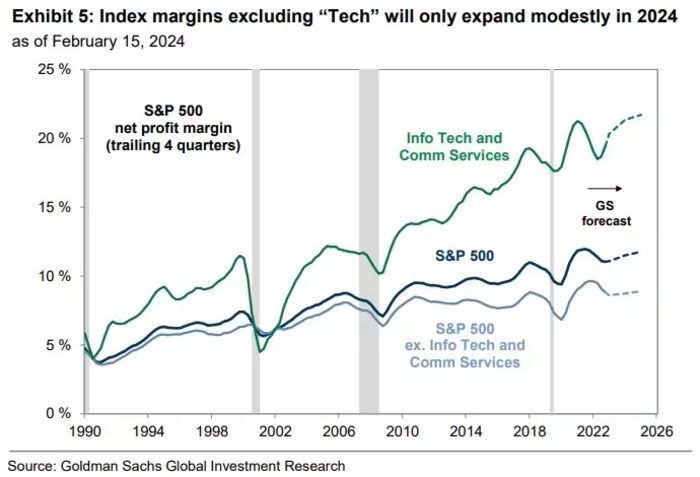

According to David Kostin, chief U.S. equity strategist at Goldman Sachs, the upgraded 2024 EPS forecast of $241 (8% growth) exceeds the median top-down strategist forecast of $235 (6% growth). This reflects expectations for robust economic growth and increased profits in the Information Technology and Communication Services sectors, which encompass five of the ‘Magnificent 7’ stocks.

Goldman Sachs aligns with other optimistic forecasters like Oppenheimer’s John Stoltzfus and Fundstrat’s Tom Lee, who also anticipate a 5,200 finish for the S&P 500. This follows Goldman’s previous adjustment from 4,700 to 5,100 in late December, alongside similar moves from RBC Capital and UBS earlier this year.

The upbeat economic forecast stems from Goldman’s economists revising their 2024 real U.S. GDP growth forecast to 2.4%, fueled by robust consumer spending and residential investment. However, the bank emphasizes that the outlook heavily depends on the performance of Big Tech.

Analysts highlight Nvidia’s upcoming earnings as a significant market event, with expectations for over a 700% surge in earnings per share compared to the same quarter last year. The company’s performance is seen as pivotal for overall market sentiment.

Goldman Sachs anticipates that the Information Technology and Communications Services sectors, which include five of the Magnificent 7 (Meta, Microsoft, Apple, Alphabet, and Nvidia), will lead in earnings growth within the S&P 500 this year, while the rest of the index may see more modest improvements.

The bank notes that the strength of Big Tech has also influenced upward revisions in earnings estimates among its peers, with Magnificent 7 earnings estimates and margins forecasts surpassing those of other stocks.

While Goldman Sachs acknowledges potential upside risks from stronger-than-expected U.S. growth or positive surprises from major companies, it also warns of downside risks from disappointing macroeconomic growth or underperformance from key stocks. Additionally, any acceleration in input cost inflation could dampen the outlook for profit margins and overall corporate earnings growth.