AI Frenzy Spells Trouble: Contrarian Investor Sounds Off on Tech Stock Risks

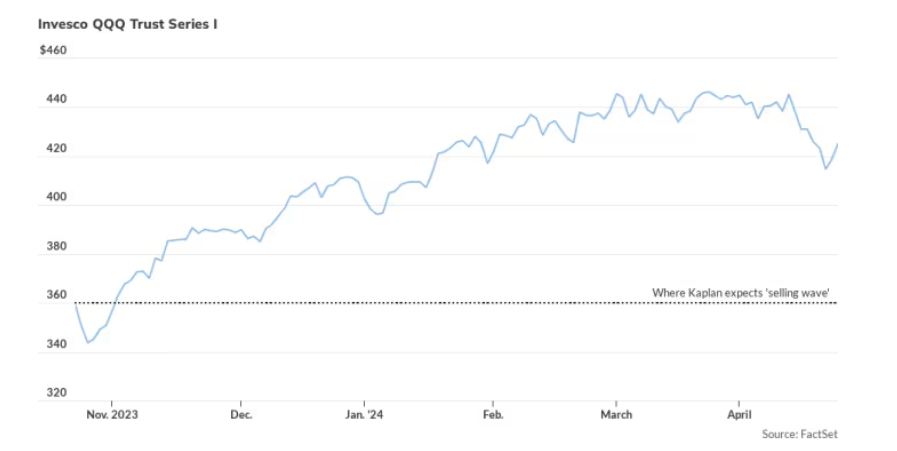

Tech stocks may be gearing up for a comeback, but Steven Jon Kaplan, CEO of True Contrarian blog and newsletter with $120 million under management, warns of a potential repeat of history. He foresees the Invesco QQQ Trust Series, which mirrors the Nasdaq-100, plummeting from its current 427 to below 300 within a year, with even grimmer prospects over three years.

Kaplan suggests that the fervor for artificial intelligence (AI) in companies like Microsoft and Apple might not translate into the expected profits. Despite heavy investment in AI chips, returns have been lackluster due to the steep costs of hiring AI engineers and uncertain profitability.

He cautions that investors might be overestimating these companies’ worth, drawing parallels to the irrational exuberance of the late 1990s dot-com bubble.

Using law firms as an illustration, Kaplan underscores how AI adoption could lead to cost savings for clients but decreased revenues for the firms themselves. He has been betting against the QQQ since February, observing hedge funds’ behavior as they typically follow a pattern of initial enthusiasm followed by significant shorting once assets cool off. Kaplan predicts a substantial selling wave if the QQQ dips to around 360, driven by hedge fund actions.

To gauge market sentiment, Kaplan looks for insider buying in tech stocks and significant outflows from U.S. stock funds. He believes that a reversal in these trends could signal a buying opportunity. Meanwhile, he favors “boring” investments like the iShares 20+ Year Treasury Bond ETF, anticipating significant gains due to undervaluation.

Additionally, he anticipates a rebound for the Japanese yen, which has been suppressed due to government policies favoring exports, and holds exposure to the Invesco Currency Shares Japanese Yen Trust.