The Year of Cash: Outperforming Bonds in 2024 Amid Speculation of a Fed Pivot

UBS forecasts that securing consistent returns through carry and income compounding will be the primary driver of fixed income performance in the upcoming months.

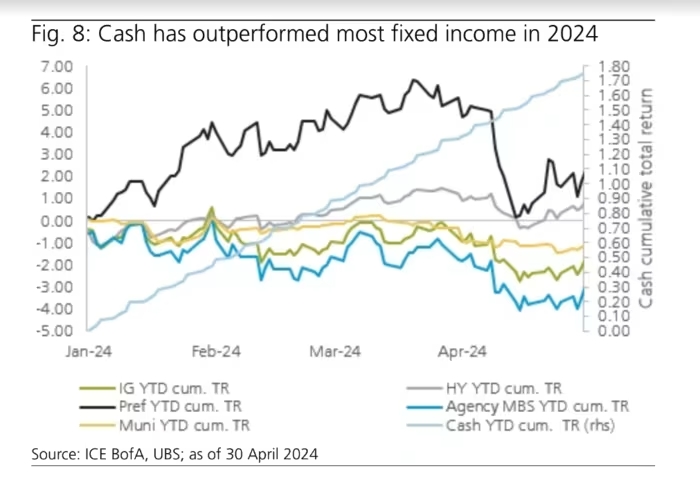

Cash has notably outperformed many segments of the bond market in 2024, a trend celebrated by enthusiasts of a more relaxed investment strategy, colloquially known as “T-bill and chill.”

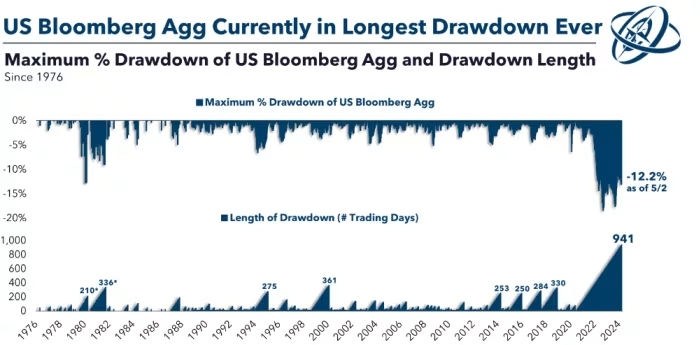

The Federal Reserve’s cautious stance on rate cuts this year, due to persistent inflationary pressures, has contributed to cash’s dominance over bonds.

By the end of April, cash had yielded a total return of 1.8%, surpassing the roughly 0.9% return from high-yield bonds. However, municipal bonds, investment-grade bonds, and agency mortgage-backed securities have faced negative returns.

Leslie Falconio, leading a team at UBS global wealth management, highlighted the adverse impact of the rapid rise in interest rates on fixed income sectors in April. Notably, preferred securities experienced a significant setback with a -3.85% performance dip during the month.

Despite these challenges, Falconio’s team underscores the importance of capitalizing on carry and compounded income to optimize fixed income performance going forward. They note the recent opportunity to secure higher yields, anticipating a potential decline in rates as summer approaches.

While bond yields have stabilized in May following remarks from Fed Chair Jerome Powell, uncertainties remain. Powell indicated a reluctance to pursue further rate hikes unless prompted by cooling inflation or unexpected labor market weaknesses.

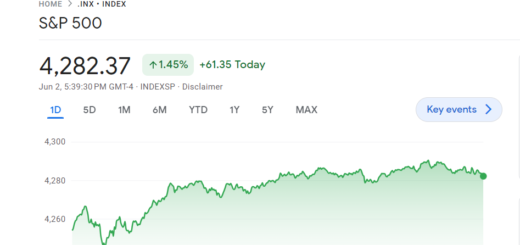

In contrast, the equities market has seen gains year-to-date, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite Index all posting positive performances.