Why U.S. Stocks May Struggle Amid Inflation and Earnings Volatility

This week’s spotlight for the stock market is on Wednesday’s inflation report, set against a backdrop of significant earnings announcements from major retailers and a retail sales update.

Wall Street is increasingly uneasy about the U.S. economy’s health, and the strain on American households could be confirmed in this week’s economic and earnings reports, potentially derailing the stock market’s recovery after its worst day in two years.

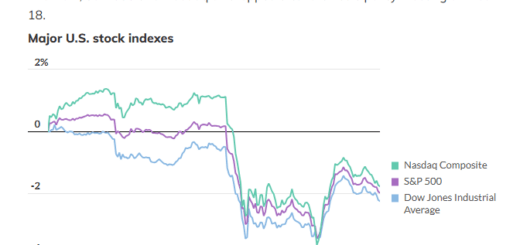

Last week, U.S. stocks concluded a turbulent period marked by the unwinding of a yen-driven carry trade and fears of a weakening U.S. economy, which rattled global financial markets. Despite the volatility, the major indexes ended the week just short of reversing their losses.

The S&P 500 dipped by less than 0.1% for the week, the Nasdaq Composite fell 0.2%, and the Dow Jones Industrial Average dropped 0.6%, according to FactSet data.

Now, the focus shifts to a new wave of U.S. economic data, including July’s Consumer Price Index (CPI), a retail sales update, and earnings reports from top U.S. retailers. Investors are watching closely to see if American households are facing greater stress from high inflation and rising interest rates.

“Markets have temporarily calmed after a brief panic over hard-landing risks,” said Michael Gapen, an economist at BofA Global Research. “Upcoming data will reveal whether the economy is slowing gradually or sharply.”

As always, the CPI report is crucial, but this time, investors are especially concerned that signs of an economic slowdown or persistent inflation could trigger another downturn in stocks.

Economists surveyed by the Wall Street Journal expect headline inflation to remain steady at 3% year-over-year in July, while core CPI, which excludes volatile food and energy prices, is forecasted to ease slightly to 3.2% from 3.3% in June.

Brian Weinstein, head of global markets at Morgan Stanley Investment Management, noted that inflation will likely remain above the Fed’s 2% target for some time. He pointed to persistent price increases in areas like car and home insurance, particularly in regions with rapid population growth. “These ongoing costs are cutting into consumers’ budgets every month,” Weinstein said.

Weinstein also mentioned that geopolitical uncertainties and the economic plans of the 2024 U.S. presidential candidates are contributing factors that could keep inflation elevated.

Consumers are feeling the pinch, and businesses are starting to notice.

The Fed’s strategy to curb inflation while maintaining economic growth worked well in the year’s first half, but recent months have shown early signs of a consumer spending slowdown, as highlighted by several companies focused on consumer goods.

For instance, luxury-goods giant LVMH recently reported a decline in second-quarter sales from its Asia (excluding Japan) operations, which accounted for 30% of its first-half 2024 revenue. McDonald’s Corp. also reported that inflationary pressures are making lower-income consumers more cautious with their spending. Similarly, Airbnb Inc. expects a slowdown in leisure travel as consumers hold back on bookings amid economic uncertainty.

Years of high inflation and the Fed’s tightening policies have squeezed American households, who are now depleting the savings they built up during the COVID-19 pandemic. As a result, many consumers are becoming more selective in their spending.

“Most consumer-facing companies, like Starbucks and McDonald’s, have issued profit warnings, signaling a tough environment for consumers,” said Brad Conger, chief investment officer at Hirtle Callaghan & Co. “This reflects the exhaustion of consumers’ savings and their concerns about job security and future income.”

This makes the upcoming earnings reports from major U.S. retailers a critical event for the stock market this week.

Walmart Inc. and Home Depot Inc. are among the companies set to release earnings on Tuesday and Thursday, respectively. Investors are eager for more insights into the state of consumer spending from companies that sell essential household goods.

Conger warned that the slowdown in consumer spending could spread to other parts of the economy. “People are cutting back on all kinds of expenses, which means businesses might reduce hiring, leading to a feedback loop affecting employment and incomes,” he said.

Despite these concerns, recent economic data has shown mixed signals about growth. Last week, the service sector rebounded in July, countering fears that the U.S. might be edging closer to a recession. Additionally, the number of Americans filing for unemployment benefits fell to 233,000, a sign that the labor market may still be strong despite a soft July jobs report.

These reports helped stocks recover some of their earlier losses.

“There’s a sense of panic and fragility in the stock market right now,” Conger told MarketWatch. “Positive economic data is unlikely to dramatically shift market sentiment, and if more positive reports emerge in the coming weeks, each will have a diminishing impact on the market.”

Weinstein expects more volatility ahead, which could limit gains in the stock market. However, he added, “This doesn’t necessarily mean a hard landing or guarantee a recession.”