How Limit Orders Can Boost Your Trading using Sonic System

Hello, traders! Today, I’m excited to guide you through the Sonic Trading System, an advanced method for identifying both long and short trade opportunities. We’ll dive into how this system operates, focusing on how to leverage price action, optimize your entries and exits, and avoid common mistakes like overtrading and slippage.

The Sonic Trading System: An Overview

The Sonic Trading System is a powerful tool that provides real-time trading signals for both long and short trades. These signals are driven by price action, which means you’re making decisions based on the actual movement of price rather than relying on lagging indicators. A key feature of this system is the use of the Average True Range (ATR) to calculate targets and stops, helping traders to account for market volatility.

By understanding the mechanics of the system, you can better follow market momentum, manage risk, and position yourself for success.

Executing Long Trades: Maximizing Opportunities

Let’s start with a long signal example. Suppose the system generates a signal at 5868.25, indicating it’s time to buy. The key here is following the system’s guidance for setting targets and stops. Targets are often determined by the ATR, a metric that adjusts based on whether the market is fast or slow. For instance, if the ATR suggests four ticks of movement per candle, setting a target of 1x or 2x the ATR can offer a balanced risk-reward ratio.

One advantage of the Sonic system is that it allows traders to place limit orders instead of market orders. By placing a limit order, you can aim for a slightly better entry price, reducing slippage and maximizing your potential profit. For example, if the system suggests entering at 5868.25, you could place a limit order at 5868 or better. This way, when the market hits your target, you’ll have captured more profit, or, if the trade moves against you, your loss will be smaller.

Mastering Short Trades: Profiting in a Falling Market

The Sonic system also shines when it comes to identifying short trade opportunities. A short trade involves selling at a higher price with the aim of buying back at a lower one. For example, if a short signal is generated at 5867.75, the goal is to sell at that price and buy back lower to lock in a profit.

The system includes a useful filter line that helps distinguish between long and short trades. Any trade signal below the filter line is a short, and any trade above the line is a long. This ensures that you’re always trading with the prevailing trend, reducing the risk of getting caught on the wrong side of a move.

As with long trades, short trades can benefit from using limit orders to secure better prices. If the system signals a short at 5867.75, placing a limit order at 5868 (or even one tick higher) allows you to sell at a more advantageous price, increasing your potential profit.

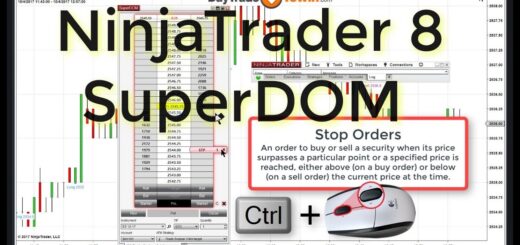

Slippage and Risk Management: Why Limit Orders Matter

Slippage, which occurs when your order is filled at a worse price than expected, can erode profits. To combat this, the Sonic system encourages the use of limit orders. By setting a limit order one or two ticks better than the system’s recommended entry, you can avoid the impact of slippage and improve your overall trade outcome.

For example, instead of entering a long trade at 5868.25 with a market order, placing a limit order at 5868 gives you a better price and reduces risk. If the trade hits your target, you earn more profit. If it hits your stop, the loss is minimized.

Managing Risk and Avoiding Overtrading

A crucial element of successful trading is knowing when to cut your losses or exit a trade. The Sonic Trading System is designed for efficiency, meaning it expects trades to hit their targets or stops relatively quickly. If your trade isn’t moving as expected within 5-10 minutes, it’s better to exit with a small win, break even, or even a small loss.

Another key point is to avoid overtrading. While it’s tempting to chase every signal, it’s wiser to limit yourself to 4-6 solid trades in a session. Overtrading can lead to poor decision-making, especially during volatile market conditions or news events.

Short-Term vs. Long-Term Targets

The Sonic system’s versatility allows for both scalping and longer-term trades. While shorter trades focus on smaller targets, you can also use the system to set larger targets based on the ATR. For instance, if the ATR suggests four ticks of movement per candle, setting a target of two times the ATR can provide a more substantial profit opportunity.

Keep in mind that while larger targets may offer bigger rewards, they also require more patience. Be sure to adjust your trading style to match your strategy.

Adapting to Market Conditions

As with any trading system, flexibility is crucial. The market is always changing, and the Sonic system allows you to adapt by tweaking entries, stops, and targets. For instance, if you notice that price action is stalling, consider exiting early to protect your account. Similarly, if the market allows you to secure a better entry price, take it!

Trading isn’t about hitting every target perfectly; it’s about making smart decisions based on the available data.

Join the Sonic Trading Community

The Sonic Trading System is part of a broader suite of trading tools that include the Trade Scalper and Atlas Line. To enhance your trading skills, consider joining a live trading room or mentorship program where you can receive real-time guidance and support. These programs allow you to learn directly from experts, ask questions, and and refine your strategy.

Ready to elevate your trading? Visit DayTradeToWin.com to open a free member account. Get access to live trading rooms, proprietary strategies like the Sonic system, and one-on-one mentorship. Whether you’re a beginner or a seasoned pro, the right tools and guidance can help you master price action trading and achieve consistent success.