Why Stick with Stocks Despite ‘Lost Decade’ Warnings

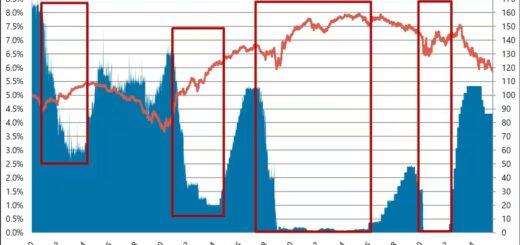

Though stocks have recently enjoyed a strong run, Deutsche Bank strategists have highlighted that stock-market returns over the past 25 years haven’t been as impressive as they might seem. Their recent report notes that, since 2000, global markets have navigated rising debt levels, slower demographic growth, and a slowdown in globalization.

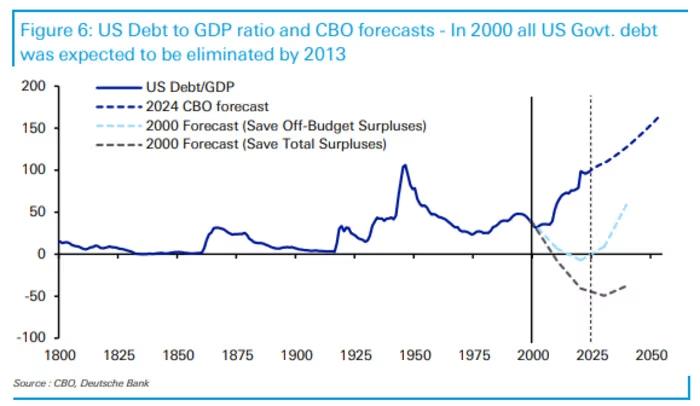

For context, in 2000, the U.S. Congressional Budget Office projected that federal debt could be paid off by 2013; instead, the debt-to-GDP ratio has surpassed 100%, a level not seen since just after World War II.

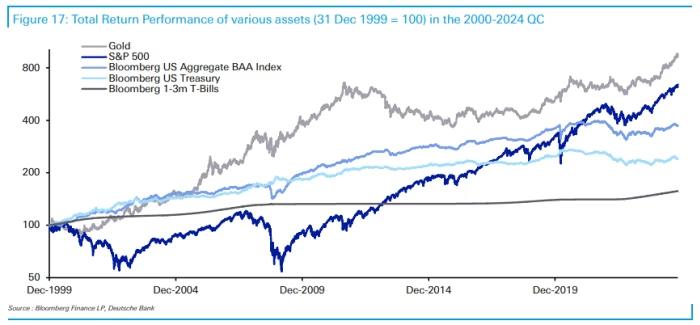

From the perspective of stock performance, the S&P 500’s returns since December 31, 1999, tell a story shaped by setbacks, including the dot-com crash, the 2008 financial crisis, and the inflation surge in 2022.

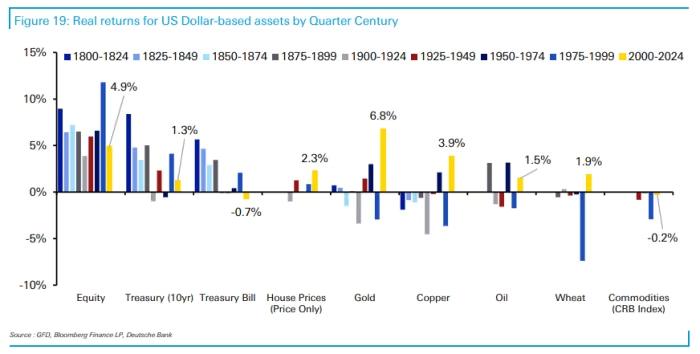

These factors have left this 25-year stretch with the second-lowest annualized returns out of nine periods dating back to 1800—only the early 20th century fared worse. This serves as a reality check for those expecting uninterrupted stock market growth, especially as some analysts, including those at Goldman Sachs and Vanguard, warn of single-digit returns in the years ahead.

Adding to this perspective, Deutsche Bank’s analysis shows that stocks haven’t just delivered lower returns in absolute terms; they’ve also lagged behind other assets like gold. Since 1999, gold has achieved annualized returns of 6.8%, surpassing the S&P 500’s 4.9%.

Even in 2024, gold slightly outperformed stocks, with a year-to-date gain of 25.6%.

Despite these challenges, Deutsche Bank maintains that equities remain a solid choice for long-term investors. Historically, stock underperformance doesn’t tend to last more than a decade, and with global debt rising, there’s an increased likelihood of future inflation.

In such periods, stocks have historically outperformed bonds, which suffered significantly in 2022.