2025 Market Outlook: Key Investor Worries

Deutsche Bank Research: Shifting Market Risks for 2025

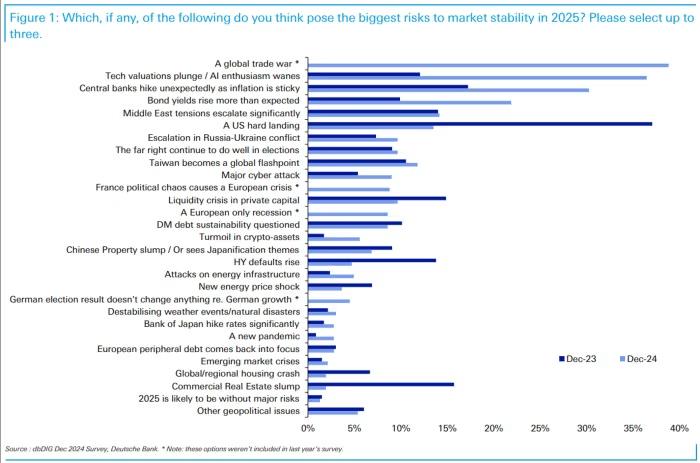

Investor concerns about market stability have shifted significantly heading into 2025, with a potential global trade war now viewed as the top risk, according to Deutsche Bank Research. This marks a departure from last year when a U.S. economic “hard landing” was the most cited concern.

“The leading global risks are a potential trade war, a sharp decline in the U.S. tech sector, and renewed inflationary pressures,” said Jim Reid, Deutsche Bank’s global head of macro and thematic research, in a Monday note. The report highlights how investor sentiment has evolved over the past year.

Trade War Concerns and Inflation Risks

While the U.S. economy expanded in 2024 despite fears of a recession, investor focus has turned to the implications of new tariffs under President-elect Donald Trump’s trade policies. A rise in tariffs could exacerbate inflation, which remains a lingering concern despite the Federal Reserve’s shift toward looser monetary policy in September.

Deutsche Bank’s research also shows that investors remain wary of potential surprises from central banks, including unexpected rate hikes to combat inflation. Bond market volatility has heightened these concerns, with the 10-year Treasury yield climbing to 4.397% on Monday, its elevated levels raising the specter of destabilizing effects on equity markets.

Tech Stocks and AI Momentum at Risk

A sharp drop in tech stock valuations ranks as the second-largest market risk heading into 2025. Tech stocks have led the market rally in 2024, driven by enthusiasm for artificial intelligence. For instance, Nvidia’s stock has soared over 166%, and the Nasdaq Composite has gained 34.4% year-to-date. Additionally, the Roundhill Magnificent Seven ETF, which includes major tech firms, is up 73.2% for the year, per FactSet data.

However, investors are concerned that waning AI-driven enthusiasm could trigger a correction in the tech sector, which has an outsized influence on broader market performance.

Outlook for 2025

Despite these risks, Deutsche Bank’s survey reveals cautious optimism for 2025. Investors project a 5.2% gain for the S&P 500 and a 6.8% increase for the Magnificent Seven stocks. Still, the specter of geopolitical tensions, inflationary pressures, and central bank policy uncertainty could weigh heavily on markets.

As the Federal Reserve prepares to announce its latest interest rate decision on Wednesday, market participants are closely watching for signals about the trajectory of monetary policy. With 2024 delivering strong equity gains—the S&P 500 is up 27.3% year-to-date—investors remain vigilant about emerging risks that could shape the market landscape in the year ahead.