S&P 500 Rapid Correction: A Turning Point?

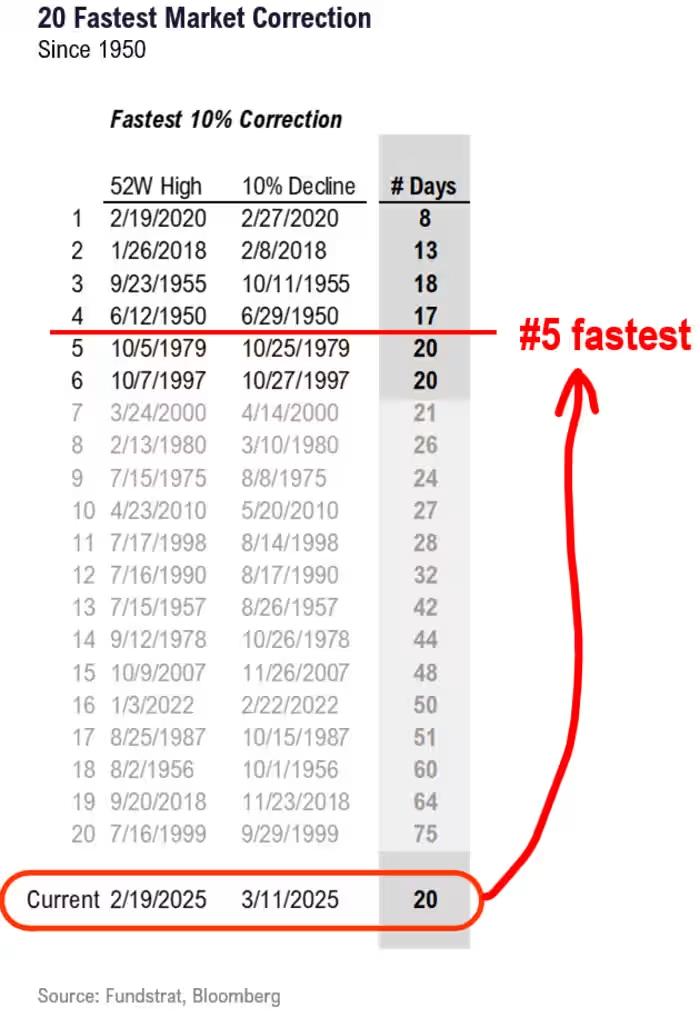

The S&P 500 recent slide into correction territory occurred at the fifth-fastest pace since 1950, according to Fundstrat’s Tom Lee. Historically, such swift declines have been followed by a rebound within three months.

The speed of this selloff has taken investors by surprise. Just a few months ago, markets were riding a wave of strong returns. Now, concerns over President Trump’s aggressive policy moves—mass federal layoffs and escalating trade tensions—are fueling recession fears. Major investment banks, including Goldman Sachs and J.P. Morgan, have raised the likelihood of an economic downturn before year-end.

Despite the volatility, Lee sees opportunity. His latest report, shared with MarketWatch, suggests corrections often serve as attractive entry points for bold investors.

A Look at Market History

The two fastest corrections in recent history occurred during the COVID-19 crash (February 2020) and the “volmageddon” selloff (January 2018), taking just eight and 13 days, respectively, for the S&P 500 to drop 10%. Outside of the COVID-19 crash, stocks typically began recovering within a month.

Lee’s data shows that in six similar corrections, the S&P 500 gained a median of 9% in three months, 15% in six months, and 21% within a year. While the sample size is small, the trend suggests that sharp declines often lead to swift recoveries—unless accompanied by a recession.

Recession Concerns vs. Market Signals

Lee remains skeptical of the growing recession fears. He points out that corporate bond markets remain stable, and global equities—particularly in Europe and China—continue to perform well despite U.S. trade tensions. Additionally, the Federal Reserve’s willingness to intervene, reflected in falling Treasury yields, suggests a potential safety net for investors.

Lee also argues that the current 10% market pullback is pricing in a roughly 40% chance of a recession—far from a certainty. Historically, stock declines during recessions have averaged 24%, meaning this downturn could remain a correction rather than a full-blown bear market.

What’s Next for Investors?

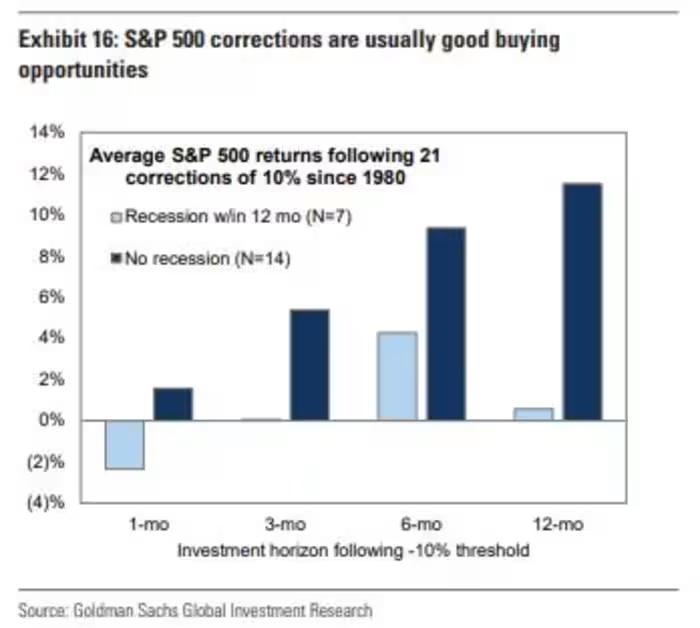

Goldman Sachs strategists highlight that since 1980, there have been 21 market corrections of 10% or more. The key differentiator in recovery has been whether a recession followed. During non-recessionary periods, stocks rebounded significantly.

For now, Goldman recommends shifting toward defensive stocks less dependent on economic growth, along with trending themes like artificial intelligence.

Market volatility persisted on Wednesday, though the S&P 500 climbed 0.5%, paring some losses from its February peak. The Dow Jones remained in negative territory, while the Nasdaq Composite surged over 1%, led by a strong performance from semiconductor stocks like Nvidia, which jumped 6.4%.