Navigating the Market Maze 📊: Harnessing Options Strategies to Embrace Uncertainty 🌪️

As the quarter nears its end, the stock market appears to be losing steam amid speculations that investors are coming to terms with the potential delay of a Fed rate hike in 2023. Both the S&P 500 and Nasdaq Composite have experienced five losing sessions in the last six.

In the past three months, the S&P index surpassed the critical resistance level of 4,200 in June, setting the stage for a battle between bulls and bears and creating uncertainty for investors. A team at Evercore ISI, led by Julian Emanuel, observed this development.

Nonetheless, they urge investors to “embrace the uncertainty” and offer insights on managing the potential direction of stocks this summer.

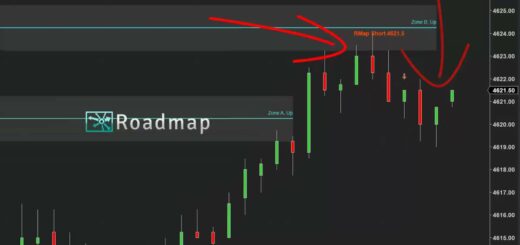

According to Emanuel and his team, the breakout above 4,200 led to an influx of funds into stocks and a significant covering of record S&P 500 short futures positions. They highlighted that all these “new longs” would be “underwater” at 4,200, providing the following chart as evidence:

Conversely, the pullback at 4,450 highlights the common and volatile nature of momentum market corrections, as observed in 2021 and 1999. Strategists suggest that a return to 4,450 could rekindle the “chase” similar to the 127% rise in the Nasdaq 100 after the 14.1% decline in 1999.

In essence, the stock market may see another clash between bears and bulls this summer. For investors hesitant to take sides, Evercore proposes employing a strangle options strategy. This approach involves holding calls and put options with different strike prices but the same expiration dates and underlying assets.

To recap, calls are options contracts that give the holder the right (but not the obligation) to buy the underlying security at a predetermined price by a specific deadline, while puts