Navigating Upside-Down Financial Markets: Morgan Stanley’s Expert Insights for Investors

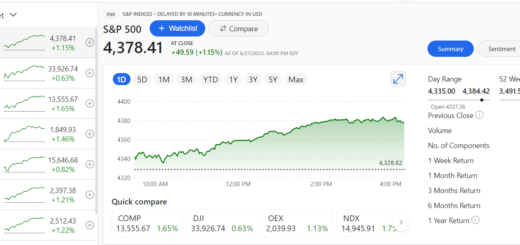

With the readjustment of the Nasdaq 100 and the expiration of options valued at around $2 trillion behind us, the market now focuses on a multitude of earnings releases and rate decisions from the Federal Reserve, European Central Bank, and Bank of Japan before heading into the quiet summer period.

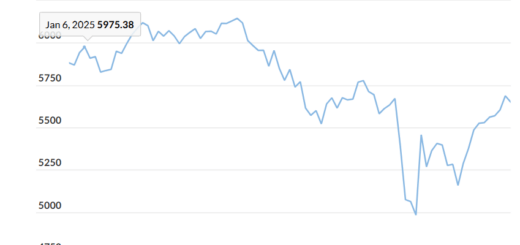

Morgan Stanley has regularly expressed its surprise at the resilience of this year’s stock market, which has achieved an 18% increase in the S&P 500 SPX, +0.03% and a 34% rise in the Nasdaq Composite COMP, -0.22%.

Chief Cross-Asset Strategist Andrew Sheets notes that forward earnings estimates for both global equities as represented by the MSCI All-Country World Index, and the U.S. with the S&P 500 as an indicator, have remained stagnant this year. This indicates that valuation increases have driven the entire market gains. Over the past 25 years, he highlights that there have only been two occurrences of stronger multiple growth – in 2009 and 2020 – both characterized by severe recession and significant monetary easing, thus supporting the argument for elevated valuations ahead of an eventual recovery.

Furthermore, Sheets refers to 1998 and 2019, when multiples increased despite a shrinking Fed balance sheet and dropping earnings per share. Interestingly, core inflation during these times hovered around 2%. He points out that, “Coincidentally, both 1998 and 2019 experienced underwhelming market performances during August-September, followed by multiple Fed rate cuts in the latter half of the years.”

Sheets also emphasizes that unusual developments are happening within the capital structure, where higher returns on senior debt arrangements are observed compared to more junior exposures, resulting in an atypical inversion.

As an example, he cites the yield on investment-grade corporate bonds at 5.4%, which surpasses the forward earnings yield for the Russell 1000, recorded at 4.8%. In the last two decades, this discrepancy has only been more pronounced 2% of the time. Similarly, the yield on U.S. investment-grade real estate investment trusts comes in at 5.8%, exceeding the average U.S. commercial real estate cap rate, or the underlying real estate yield, of 5.4%. Additionally, the gap between the yield on a collateralized loan obligation’s collateral and its weighted cost of liabilities is at the 7th percentile within the past ten years for both the U.S. and Europe.

Sheets acknowledges that there are varying explanations behind these unusual inversions, and it is reasonable for debt to be pricier than its underlying asset amid strong growth. However, he adds, “This compression, and even a flip, in the capital structure implies that growth expectations have shifted considerably since the beginning of the year. In scenarios where growth remains solid or slows down, we think that debt generally offers a better risk/reward balance, especially when this capital structure inversion increasingly drives economic incentives to de-leverage.”