S&P 500’s September Suffering: Inflation’s Toll on Markets

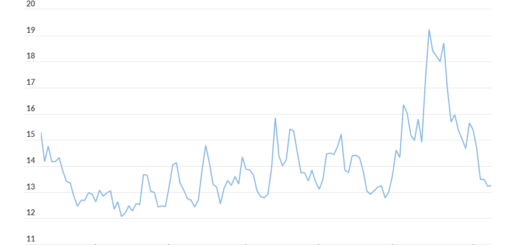

In September, the S&P 500 experienced its most substantial monthly decline since December of the previous year, with a 4.9% loss.

On Friday, U.S. stock markets closed with most indices in the red as investors assessed the latest inflation data from the Federal Reserve. This marked the conclusion of a turbulent month for stocks.

Here’s a snapshot of how key indices performed:

- The Dow Jones Industrial Average (DJIA) fell by 158.84 points, or 0.5%, closing at 33,507.50.

- The S&P 500 (SPX) shed 11.65 points, or 0.3%, ending at 4,288.05.

- The Nasdaq Composite (COMP) saw a modest gain of 18.05 points, or 0.1%, closing at 13,219.32.

For the week, the Dow registered a 1.3% decline, the S&P 500 dropped by 0.7%, while the Nasdaq Composite managed to eke out a 0.1% gain. All three indices reported both monthly and quarterly losses.

Factors influencing the markets:

The S&P 500 wrapped up Friday with a slight decline, marking its fourth consecutive week of losses. Initially, U.S. stocks posted gains at the opening bell following the release of the latest inflation data.

Investor sentiment has been fluctuating between concerns about a potential U.S. economic recession and the possibility of a “soft landing” facilitated, at least in part, by Federal Reserve interest rate hikes aimed at combatting inflation. According to Brent Schutte, Chief Investment Officer at Northwestern Mutual Wealth Management Co., this uncertainty has left investors searching for answers.

September saw the S&P 500’s worst monthly performance, with a 4.9% decline, according to FactSet data.

Schutte characterized it as a “tough month for stocks.”

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, noted that the declining breadth in the U.S. stock market might have attracted some “dip buyers” on Friday morning. She added that the inflation data from the Federal Reserve’s preferred gauge, released before the market opened, didn’t significantly impact stocks, as there were no major surprises in the data.

The PCE (personal-consumption expenditures) index showed that core prices, excluding volatile food and energy categories, increased by 0.1% in August, a lower-than-expected rise. Additionally, the year-over-year inflation rate eased to 3.9%.

However, rising energy prices contributed to a 0.4% increase in the headline PCE price index in August, marking its most significant increase in seven months.

According to Carol Schleif, Chief Investment Officer at BMO Family Office, the core PCE still remains nearly double the Fed’s 2% target, prompting the Fed to consider the possibility of another interest rate hike.

Callie Cox, U.S. Investment Strategist at eToro, highlighted the decline in services inflation, with prices rising by 4.9% from the previous year in August. This moderation in services inflation aligns with the Federal Reserve’s goals as they approach the end of rate hikes.

Higher long-term yields have continued to exert pressure on stocks. On Friday, the yield on the 10-year Treasury note (BX:TMUBMUSD10Y) decreased by 2.4 basis points to 4.572%, although it remained near 16-year highs reached earlier in the week, according to Dow Jones Market Data.

In other economic data released on Friday, the Bureau of Economic Analysis estimated that personal income increased by 0.4% in August, with consumer spending also up by 0.4%.

There are signs of cooling consumer spending, particularly in the services sector, as per Northwestern Mutual’s Schutte.

Investors also received updates from the Chicago Business Barometer, which registered at 44.1 in September, representing its first drop in three months. Meanwhile, the University of Michigan consumer-sentiment index showed sentiment improving slightly at the end of September, with the final reading rising to 68.1 from 67.7 earlier in the month. The University of Michigan data included a reading on inflation expectations, showing respondents expected inflation to decrease further to 3.2% in a year’s time.

Some analysts attributed Friday’s fading stock-market gains to portfolio repositioning by funds as they prepared for the fourth quarter, which began the following Monday. The market has been characterized by a risk-off environment for much of September.

Notable stocks in focus:

- Shares of Nike Inc. (NKE), a Dow Jones Industrial Average component, surged by 6.7% after reporting earnings that exceeded expectations.

- Nike’s rivals, Adidas AG (ADS) and Puma SE (PUM), saw their shares rise following Nike’s strong earnings performance. Adidas climbed by 6.2%, while Puma gained 5.8%.

- Fisker Inc. (FSR) announced its intention to offer additional convertible debt to an existing institutional investor, leading to a 0.3% increase in its shares.

- Blue Apron Holdings Inc. (APRN) experienced a significant 134.5% surge in its stock price after announcing an acquisition by a food-delivery startup, marking its exit from public markets at a fraction of its IPO valuation.

- Walgreens Boots Alliance Inc. (WBA) saw its shares jump by 6.4