S&P 500’s Monthly Slide: 2023’s Deepest Loss Looms as Yields Continue to Rise

Investors may be confronted with the scenario where the Federal Reserve decides to keep interest rates elevated for an extended duration. As a result, there has been a notable increase in Treasury yields, leading to the S&P 500 index enduring its most substantial monthly drop in 2023.

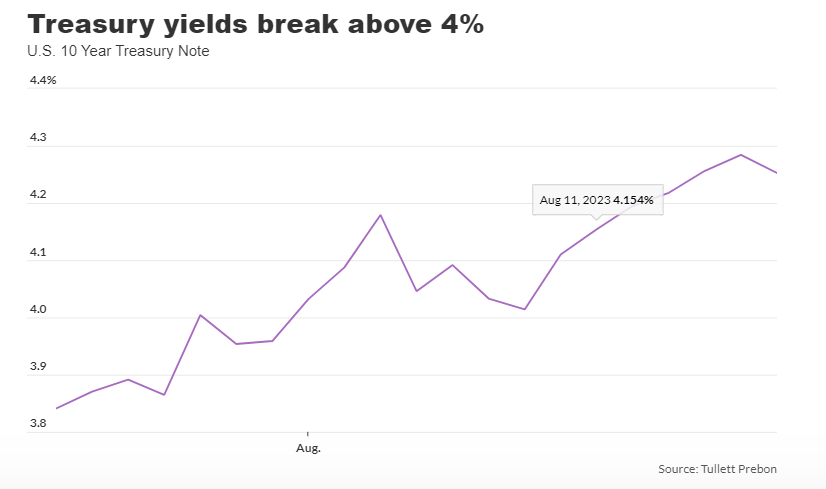

During a phone interview, Scott Chronert, an equity strategist at Citigroup, clarified that the yield on the 10-year Treasury note exceeded the trading range of 3.5% – 4% in August. This rise had a negative impact on stock market valuations, as it went against the established pattern that had been observed throughout the year.

This month, investors in the American stock market are witnessing a downturn in their investments as they anxiously await Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Economic Symposium in Wyoming, which is planned for Friday. Furthermore, they are dealing with a rise in yields throughout August and monitoring the possible consequences of China’s economic difficulties, as it is the second largest economy globally.

Investors were taken aback this month when the return on the 10-year treasury note BX:TMUBMUSD10Y, which had been increasing, reached its highest point since 2007 despite the Federal Reserve’s efforts to gradually raise interest rates due to the decreasing inflation in the United States.

During a phone interview, Rick Rieder, the chief investment officer of global fixed income at BlackRock and head of the firm’s global allocation investment team, pointed out the irony of interest rates going up while inflation decreased considerably in the last three and six months, as indicated by the moving averages of the consumer-price index.

Based on data from Dow Jones Market Data, the U.S. stock market ended the week with mostly negative results. The S&P 500 index reported its third consecutive week of losses and is currently down by 4.8% in the month of August. This represents the largest monthly decline for the index since December, according to data provided by FactSet.

Both the Nasdaq Composite COMP and Dow Jones Industrial Average DJIA concluded the week on a negative note on Friday. Similar to the S&P 500, the Nasdaq, famous for its emphasis on technology stocks, saw three consecutive weeks of decline.

Rieder pointed out that investors in the stock market are concerned that the strong condition of the American economy could prompt the Federal Reserve to tighten its monetary policy even more. This worry, combined with an increase in the amount of U.S. Treasurys being circulated, appears to be adversely affecting the stock market.

Rieder stated that there is a significant issuance of Treasury bills, causing a decrease in available funds, which he believes is starting to show some effects. These Treasury bills are short-term U.S. government debt that matures within a few months and have been yielding more than 5% recently.

Scott Wren, a senior global market strategist at Wells Fargo Investment Institute, mentioned in a telephone conversation that his company made the decision to withdraw a portion of their funds from the stock market earlier this year. Specifically, they decreased their investments in technology stocks and chose to invest in Treasury bills instead. This strategic move allows them to take advantage of opportunities when the stock market undergoes declines. Wells Fargo has a projection that the S&P 500 index will achieve a value of 4,100 by the conclusion of 2023.

Dow Jones Market Data reports that the S&P 500 closed on Friday at 4,369.71, which indicates a decline of 8.9% from its peak closing level in January 2022.

Wren stated that the Federal Reserve has yet to complete its efforts to increase interest rates in order to manage ongoing core inflation. During the Jackson Hole meeting, Chair Jerome Powell may take this chance to convey to the market that the central bank is presently not contemplating reducing rates.

Wren suggests that Powell might continue to emphasize a firm position by repeating the idea that the Federal Reserve has the ability to raise its benchmark rate as a means to combat inflation and achieve its goal of 2%.

Chair Powell has been scheduled to deliver a speech at the Jackson Hole meeting on August 25.

In a telephone interview, David Kelly, J.P. Morgan Asset Management’s chief global strategist, remarked that the current state of the U.S. economy is very strong. He also conveyed his confidence that a significant reduction in inflation can occur without causing a recession.

Investors are worried that the Federal Reserve’s continuous increase in interest rates, which were previously raised to curb high inflation, could possibly cause a decline in the economy.

Kelly states that in the absence of notable economic issues, it is improbable for interest rates to diminish by the end of this year.

But Kelly is anticipating that the Federal Reserve could potentially begin a gradual reduction of interest rates in the spring of 2024, given that inflation continues to decrease and eventually reaches 2%. He pointed out that if the labor market starts exhibiting indications of an imminent economic decline, such as consistent monthly decreases in nonfarm payroll employment reports, the central bank would probably accelerate the pace at which they lower interest rates.

Currently, 10-year Treasury yields have been consistently rising for five consecutive weeks, marking the longest streak since March. According to Dow Jones Market Data, the yields closed at 4.251% on Friday. However, they slightly decreased on Friday after reaching their highest level since November 2007 on August 17, as reported at 3 p.m. Eastern Time.

Rieder from BlackRock explains that the rise in interest rates can be credited to various reasons. These encompass the greater accessibility of U.S. government debt, the impact of the Bank of Japan modifying its yield-curve control to permit its own 10-year yields to increase, and the appeal of Treasury bills which offer a favorable rate of approximately 5.5% with no credit or duration risks.

Kelly mentioned that while the economy of the United States is flourishing, China’s economy is facing challenges. The property sector in China is currently encountering hardships, and there are worries among investors that the slowing economy of the country could potentially result in a recession.

According to Chronert from Citi, a slowdown in the Chinese economy might lead to a decrease in the need for resources. This could potentially have a deflationary effect and help companies by reducing their expenses. However, he also cautions that a downturn in China’s economy could have a negative impact on the earnings of American manufacturers and retailers who operate there.

In contrast, Chronert states that U.S. companies can expect a favorable financial outlook in the latter half of this year.

Investors are closely monitoring Powell’s actions as he tries to strike a balance between avoiding excessive slowdown of the U.S. economy and controlling inflation by implementing a policy rate that might be viewed as restrictive. Last month, the Federal Reserve raised its benchmark rate to a range of 5.25% to 5.5%, marking the highest level in 22 years.

Chronert has expressed worry about the current level of inflation, indicating that it should increase significantly in order to meet his desired goal.