The Dark Side of Buybacks: Examining Wealth Inequality and Innovation Suppression

“Reevaluating Stock Buybacks: A Force behind Wealth Inequality and Innovation Suppression?”

An ongoing debate questions the role of stock buybacks in perpetuating wealth inequality and stifling innovation within the U.S. economy. Should there be a definitive ban on these practices, especially when executed as open-market repurchases? According to William Lazonick, an esteetock marketmed figure hailing from the University of Massachusetts Lowell and also the President of the Academic-Industry Research Network, the answer is a resounding “yes.”

Lazonick, a long-standing critic of corporate stock buybacks, recently unveiled his book “Investing in Innovation: Confronting Predatory Value Extraction in the U.S. Corporation,” in which he contends that these buybacks form a critical component of what he labels as “predatory value extraction.”

The concept of predatory value extraction centers on the idea that senior executives, Wall Street financiers, and hedge fund managers manage to extract a disproportionately larger amount of value from corporations where they hold shares, in comparison to their actual contributions to value creation within those organizations.

However, the ramifications extend beyond this. These stock buybacks have inadvertently rendered American corporations more susceptible to foreign competitors, particularly in sectors critical to national security and productivity, like aviation, communications, semiconductors, and alternative energy. This vulnerability stems from businesses opting to allocate profits to buybacks instead of investing in innovation and infrastructure. As a result, these companies are compelled to procure essential technologies from foreign rivals, predominantly in Asia.

Before the widespread adoption of buybacks in the 1980s, companies typically reinvested the bulk of their profits to foster growth or reward employees for their contributions to value creation.

This narrative shifted drastically as buybacks gained momentum, becoming a popular strategy for elevating share prices by reducing the number of outstanding shares. Between 2012 and 2021, the 474 firms listed in the S&P 500 (as of January 2022) channeled a staggering $5.7 trillion into the stock market through buybacks, equating to 55% of their collective net income. Additionally, another $4.2 trillion was distributed as dividends, consuming an additional 41% of net income.

While dividends offer benefits to all shareholders, buybacks predominantly benefit those selling shares, including senior managers whose compensation often involves stock holdings and hedge fund managers aiming to capitalize on market timing.

Lazonick’s book offers various examples illustrating the shift from a strategy focused on “retain and invest” to “dominate and distribute,” and its consequences for the workforce.

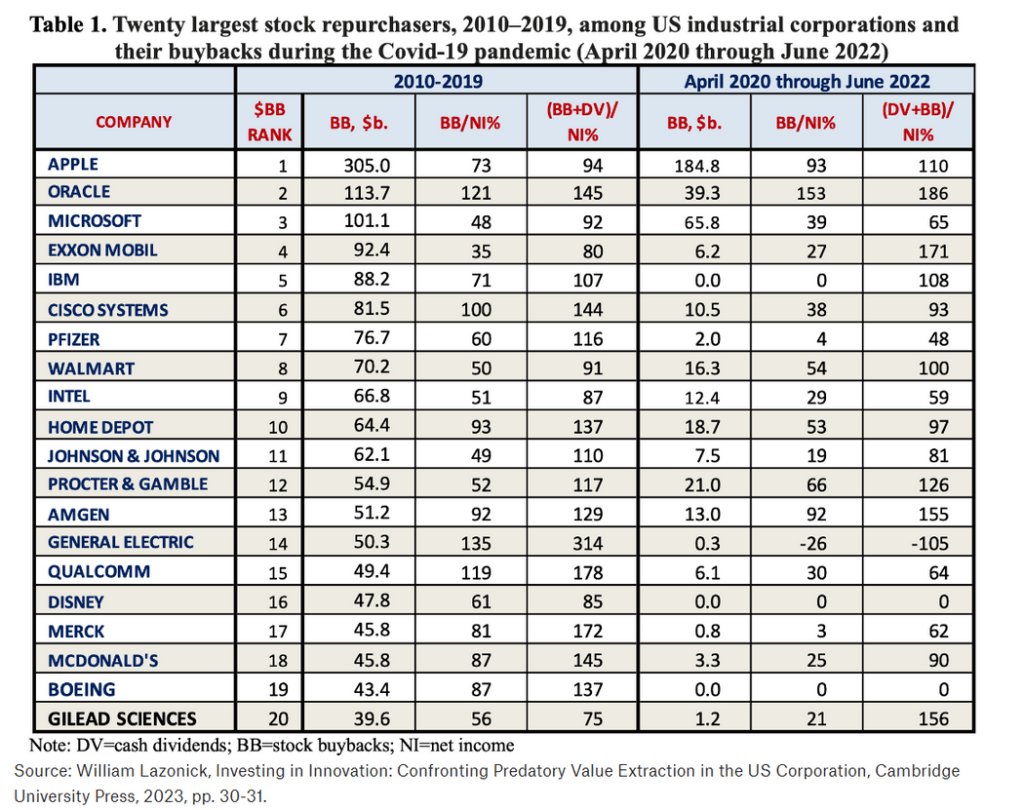

The table below highlights the top 20 purchasers of their own stock from 2010 to 2019, along with distributions made during pandemic years.

Eleven companies followed the “dominate and distribute” approach before the pandemic, encompassing major players like Apple, Oracle, Microsoft, Cisco, Walmart, Intel, Home Depot, Johnson & Johnson, Amgen, Qualcomm, and Gilead. These companies utilized profits from their commanding market positions to bolster stock prices.

On the other hand, seven firms including Exxon Mobil, IBM, Procter & Gamble, General Electric, Merck, McDonald’s, and Boeing pursued a “downsize and distribute” strategy, allocating funds to shareholders as they downsized their workforces.

The remaining two, Pfizer and Disney, ceased buybacks in 2019 to return to a “retain and invest” strategy.

Lazonick underscores that companies such as Disney, Home Depot, McDonald’s, Procter & Gamble, and Walmart employ a significant number of low-wage workers. These workers could potentially benefit from substantial pay raises funded by capital allocated to buybacks. Elevating wages and benefits for low-paid workers at profitable firms can have a ripple effect, boosting incomes across the broader economy.

Even the pharmaceutical sector, represented by companies like Amgen, Gilead Sciences, Johnson & Johnson, Merck, and Pfizer, faces scrutiny. Despite advocating for high drug prices to support research and development, these firms distributed a significant 110% of their net income to shareholders and share sellers between 2012 and 2021. Buybacks alone accounted for 55% of net income, surpassing other sectors.

Lazonick also highlights the technology sector, using Cisco Systems as an example of a company favoring buybacks over investment in learning that fuels innovative communication-infrastructure products.

Since 2001, Cisco’s management has allocated a staggering $159.7 billion to buybacks, equivalent to 93% of net income. Concurrently, the U.S. has fallen behind global competitors in areas like 5G and the Internet of Things.

Apple’s trajectory follows a similar narrative. Initially relying on Samsung Electronics to fabricate chips for iPhones, Apple shifted its outsourcing to TSMC, catalyzing the latter’s ascent to prominence in advanced nanometer chip fabrication.

According to Lazonick, five steps are crucial to curbing predatory value extraction:

- Ban buybacks executed as open-market repurchases.

- Redesign executive compensation to prioritize value creation over extraction.

- Incorporate employee and taxpayer representatives into corporate boards, excluding value extractors.

- Reform the tax system to incentivize innovation.

- Encourage investment in “collective and cumulative careers” offering lasting, rewarding employment opportunities to the labor force over their working lives.

The implications are substantial. An Oxfam report revealed that by 2022, inflation had eroded the earnings value for 32% of the U.S. labor force, leaving them with hourly wages of $15 or less.

In his 2022 State of the Union address, President Joe Biden proposed a 4% tax on buybacks. However, Lazonick argues that this is insufficient. If the administration opts for taxation instead of a ban, Lazonick suggests a 40% surcharge, accompanied by a prominent message on corporate repurchasers’ websites: “STOCK BUYBACKS DESTROY THE MIDDLE CLASS.”