The Road to Recovery: 3 Indicators to Gauge Stock-Market Pain’s Departure

Many investors are eagerly seeking signs of the stock market downtrend nearing its end, despite the S&P 500 only witnessing a 5.5% decrease since reaching its highest point in late July.

Considering this, Victor Cossel from Seaport Research Partners has presented a few technical charts that could offer some understanding about when a possible reversal may happen. Nonetheless, the crucial idea is that, at present, there is an anticipation of encountering further challenges unless the ongoing rise in Treasury yields and the U.S. dollar ceases.

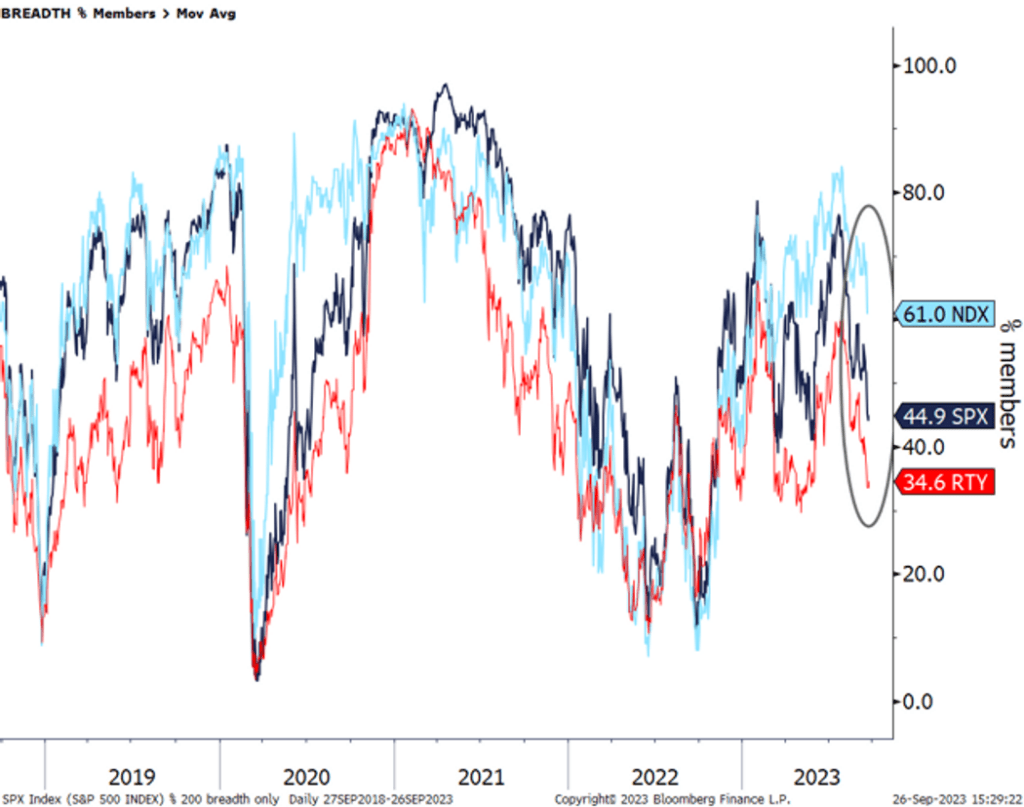

At first, it is important for the proportion of Nasdaq 100 companies that are currently trading below their 200-day average to match the number of S&P 500 and Russell 2000 members that are also trading below their 200 DMAs.

Analysts utilize moving averages to evaluate the speed and trajectory of a specific financial asset. Through analyzing these trends in the constituents of an index, analysts can ascertain the degree to which the performance of said index is dependent on a chosen few stocks. This trend has been especially prevalent in the U.S. stock markets over the year, largely attributable to the emergence of the renowned “Magnificent Seven.”

The term “Magnificent Seven” is used to describe a group of prominent technology stocks that have seen substantial growth as a result of the increasing popularity of artificial intelligence. This group encompasses companies like Nvidia Corp., Microsoft Corp., Apple Inc., Meta Platforms Inc., Tesla Inc., Amazon.com Inc., and Alphabet Inc.’s Class A and Class C shares.

According to the latest information from Cossell, which was current until the close of trading on Monday, 61% of Nasdaq 100 NDX members were above their 200-day moving averages. In comparison, the percentages were 45% for the S&P 500 SPX and 35% for the Russell 2000 IWM. However, these percentages may have altered slightly due to a notable drop in U.S. stock prices on Tuesday.

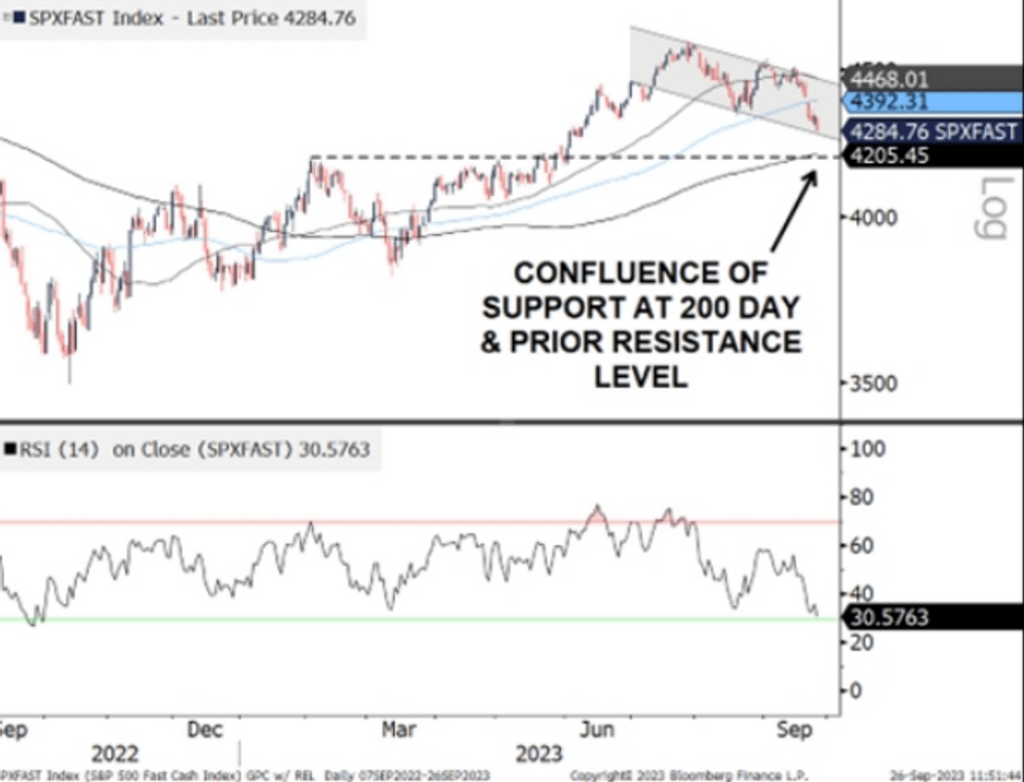

If there is more pressure to sell, traders will closely monitor whether the S&P 500 can continue to stay at 4,200 points, a level that has served as a solid base for the large-cap index for a long time.

If the stock market goes down to a level lower than 4,200, it may suggest negative outcomes for the future. Traders would perceive this decrease as a sign that the downwards trend is becoming more powerful.

However, the excessive excitement and speculation in the market, which potentially impacted the Federal Reserve’s decision to signal consistent increases in interest rates, are slowly decreasing.

One example of this can be seen when the information-technology section of the S&P 500 experienced a correction on Tuesday. It closed at 2,869.6, a decrease of 1.8% in value. This drop caused the index to decline by 10.5% from its highest point in the past year, which was 3,207.29. When a stock or index falls by 10% or more from its recent peak, it is categorized as being in correction territory.

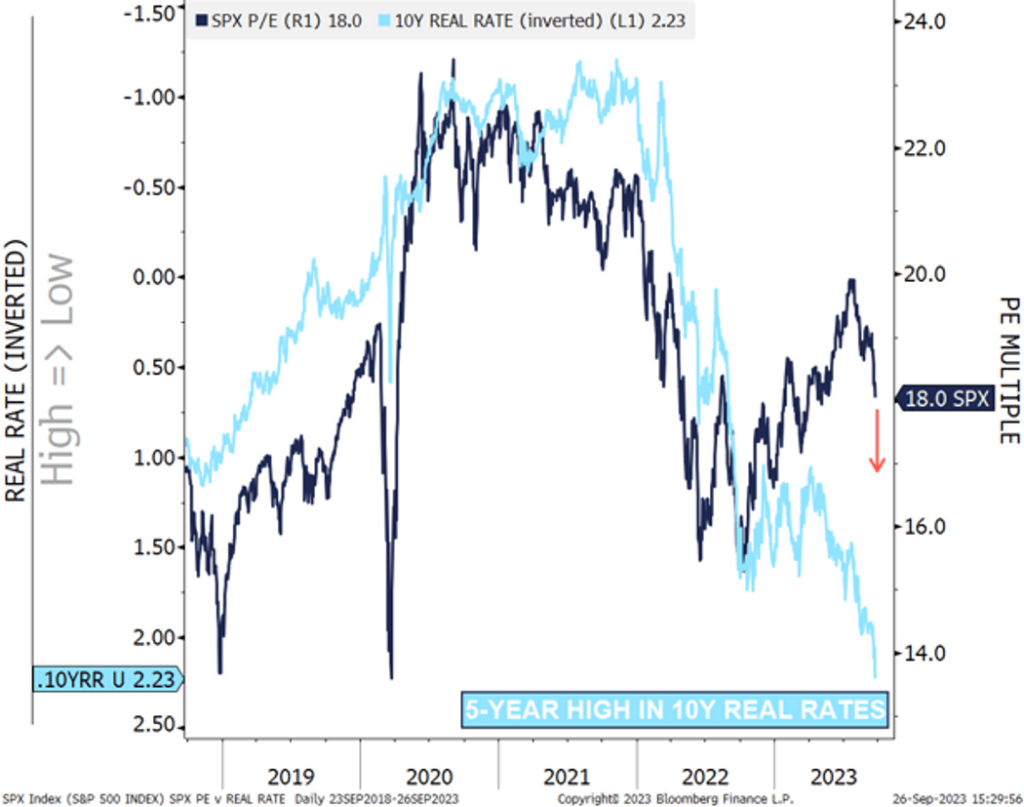

The interest rate plans revealed by the central bank after its September policy meeting have been widely cited as the main reason behind the recent changes in Treasury yields and the value of the dollar.

The stock market may encounter difficulties if bond yields adjusted for inflation, known as real rates, continue to rise. This was illustrated by Cossel in a chart depicting the S&P 500’s valuation based on the future price-to-earnings ratio, which reveals a significant disparity compared to the current trading of 10-year real rates.

In this particular situation, Cossel used the actual rate of interest, known as the 10-year nominal Treasury yield BX:TMUBMUSD10Y. However, this rate has been adjusted by considering the difference between the 10-year Treasury yield and the expected inflation rate, also known as the 10-year breakeven spread.

Cossel indicated in the message that if rates do not go down, there is a chance that the S&P 500 could face some vulnerability while remaining at its present levels.

The U.S. stock market faced notable declines on Tuesday, as the Dow Jones Industrial Average saw its biggest drop in a single day since March. Additionally, Treasury yields rose and the ICE U.S. Dollar Index reached its highest point in 10 months, indicating a stronger value for the U.S. dollar. Specifically, the ICE U.S. Dollar Index increased by 0.2% to 106.18, as mentioned.

The Dow Jones Industrial Average fell by 338 points, indicating a 1.1% decrease to its present value of 33,618.88. In a similar vein, the S&P 500 index dropped by 63.91 points, or 1.5%, reaching 4,273.53. Likewise, the Nasdaq Composite index experienced a decrease of 207.71 points, reflecting a 1.6% decline, resulting in a new level of 13,063.61.