Insights from a Former Hedge Fund Star: The Next Bear Market Signal

What hangs in the balance with the release of Tuesday’s CPI data?

Many in the financial world are expecting a decrease in inflation, but if the numbers surpass expectations, it could dampen hopes for a rate cut in May, potentially affecting the S&P 500’s climb towards 5,000, warn some analysts.

Despite this, given Nvidia’s impressive 47% increase this year and the frenzy surrounding AI companies like ARM, it appears prudent to refrain from opposing the momentum, at least for now. Indeed, the latest fund manager survey from Bank of America shows continued enthusiasm for tech stocks.

So, what might eventually trigger a downturn in this market? Former hedge-fund manager Russell Clark suggests looking to Japan, where loose monetary policy persists as a significant factor.

Clark, despite stepping away from his consistently bearish RC Global Fund in 2021 after a decade of misjudgments on stock markets, presents a compelling argument regarding Japan’s importance.

In his recent Substack post, Clark argues that the true catalyst for a bear market could arise when the Bank of Japan ends quantitative easing. He suggests that we’re in a “pro-labor world,” where certain economic trends should be emerging: increasing wages, declining unemployment, and interest rates trending higher than anticipated. In line with his analysis, real assets began surging in late 2023 as the Fed adopted a dovish stance and the yield curve steepened.

However, subsequent events haven’t unfolded as expected. While Clark anticipated that higher short-term rates would divert money from speculative assets, funds instead flowed into cryptocurrencies like Tether, and the Nasdaq fully recovered from its 2022 decline.

Returning to Japan, Clark offers a less conventional explanation for the resilience of financial and speculative assets.

He points out that during the 1990s, despite the Fed maintaining high interest rates, the dot-com bubble thrived. However, the bubble eventually burst when the Bank of Japan raised rates in 1999. Similarly, Japan’s attempt to raise rates in 1996 is associated with the Asian Financial Crisis.

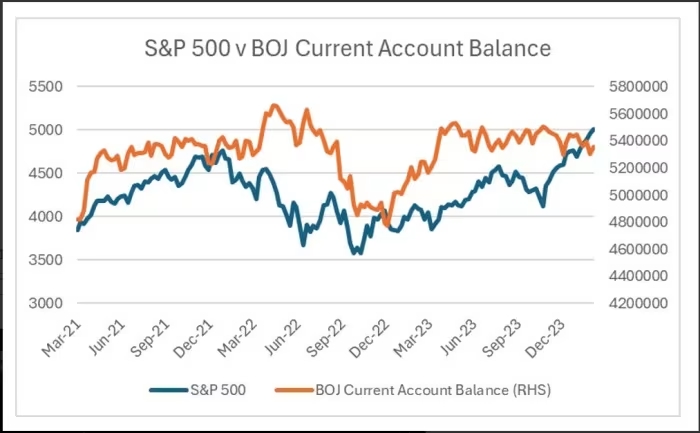

According to Clark’s analysis, it seems that markets are more sensitive to the Bank of Japan’s balance sheet than to the Fed’s policies. He argues that the BOJ’s introduction of quantitative easing in the early 2000s preceded the subprime crisis, which erupted shortly after the BOJ withdrew liquidity from the market in 2006.

In summary, Clark suggests that the Bank of Japan is the central bank that truly matters and that a bearish stance on the U.S. might be warranted when the BOJ raises interest rates. He closely monitors the BOJ’s actions as they could signal impending market shifts.