Big Investors Absent as Bullish Sentiment Builds for This Asset Class

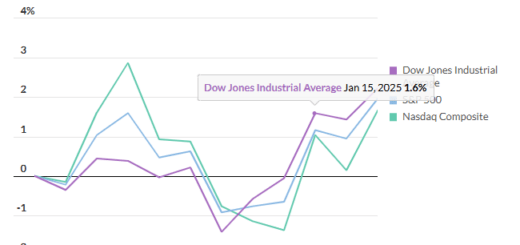

As a new quarter begins, there’s a slight dip in stock momentum compared to premarket activity. After reaching its 22nd record high, the S&P 500 closed the first quarter, suggesting a potential pause ahead.

Investors are analyzing comments from Fed Chair Jerome Powell, who recently stated that he didn’t see any surprises in the central bank’s preferred inflation measure and didn’t feel the need to lower rates urgently. More insights from Powell are expected later this week, along with key data such as job figures.

Are major investors missing out on a possibly profitable asset class right now? That’s what’s being suggested by a Sunday blog post from the Mosaic Asset Company, which highlights a “bullish case for commodities.”

Interestingly, gold prices hit new highs on Monday.

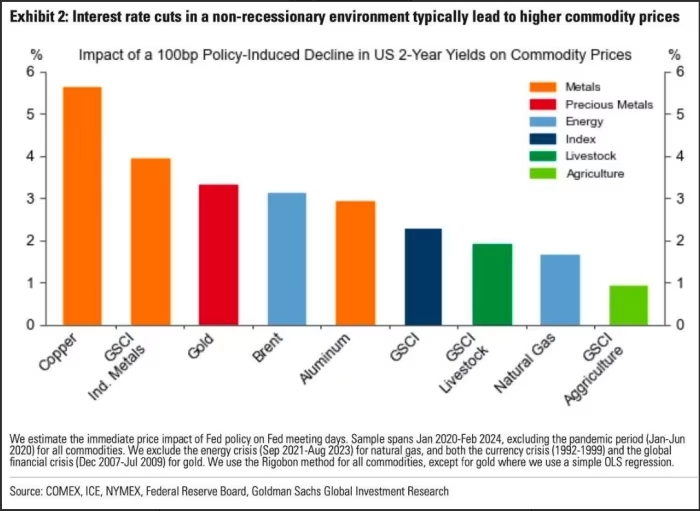

The context is that “rate cuts are expected while the economy avoids recession.” While this scenario is favorable for stocks, various commodities have also received positive attention, according to Mosaic.

Their data shows how different commodities have performed in non-recessionary periods when the 2-year yield is declining, with notable gains for copper, industrial metals, oil, and gold:

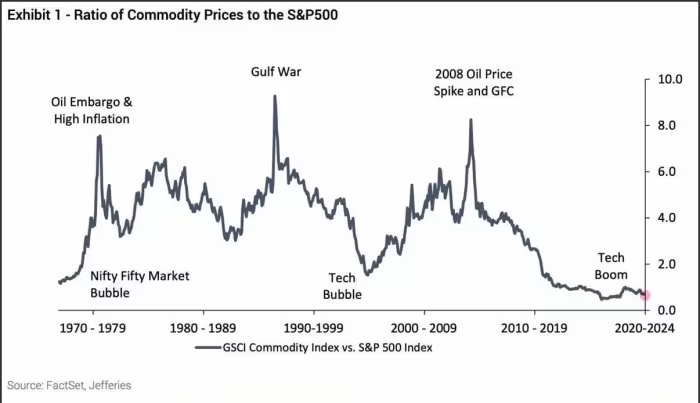

Moreover, Mosaic suggests that the commodity trade is further supported by the lack of interest from professional investors. “Commodities have significantly lagged behind, with overall price declines reflected in the S&P GSCI commodity index since mid-2022, giving fund managers little reason to chase performance.”

Referring to Bank of America’s recent survey of fund managers, Mosaic points out that institutional portfolios are currently the least exposed to commodities relative to bonds since the financial crisis of 2008. They indicate that such herd behavior can quickly reverse if commodities begin to rebound.

“Institutional investors, while evaluating their portfolio allocation, might become a driving force behind commodity demand if momentum picks up. This is particularly true considering that commodities are currently at historically discounted levels compared to equities,” states Mosaic.

They highlight that the commodities-to-stock price ratio is nearing historic lows, a situation that has previously triggered a “significant mean-reversion in favor of commodities.” Their subsequent graph illustrates this ratio dating back to 1970 — a rising trend indicating commodities outperforming stocks, and a declining trend signaling the opposite:

“Although the current ratio has lingered at low levels for much of the past decade, the environment is turning favorable for commodities to excel from these depressed levels,” they remark. Considering all these factors, there appears to be an enticing risk/reward prospect.