Decoding S&P 500: Anticipating 1% Annual Returns Ahead

The Threat Posed by Surging Profit Margins to Stocks

The upward trajectory of corporate profit margins, while currently advantageous, cannot be sustained indefinitely, potentially signaling trouble for the stock market.

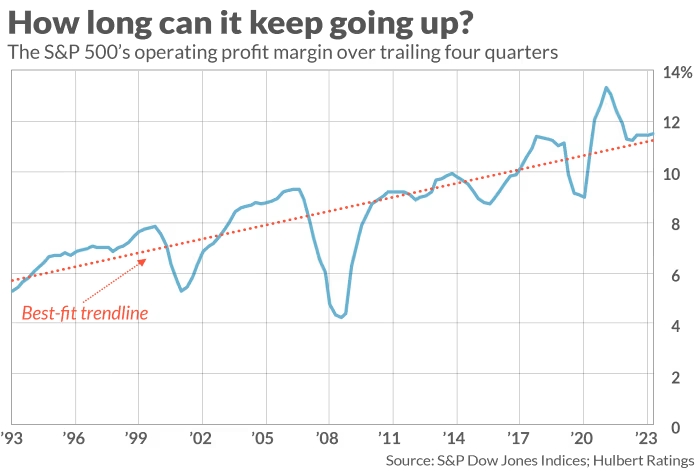

Recent data from S&P Dow Jones Indices reveals that the S&P 500’s operating profit margin for the first quarter of 2024 hit 11.76%, with the trailing four-quarter margin reaching 11.44%, surpassing figures from 2023 and 2022.

These figures mark a return of profit margins to their long-term trendline after fluctuations associated with the Covid-19 economic downturn and subsequent fiscal stimuli.

Analysts project further margin growth, with estimates indicating margins above 12% for 2024. This expansion is crucial for the current valuation of the stock market; if margins were at 1990s levels, the S&P 500 would be valued significantly lower.

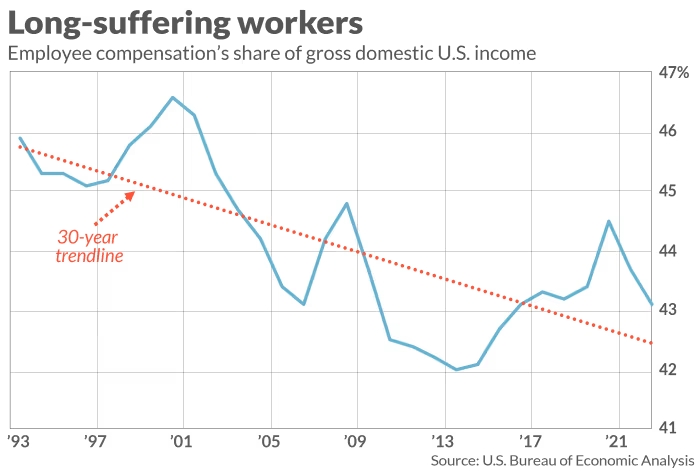

Economists are skeptical about the sustainability of margin growth, particularly given the decline in labor’s share of income over the past three decades.

While some anticipate ongoing margin expansion, others, such as Rob Arnott of Research Affiliates, predict a return to historical norms. Such a shift could dampen future market returns.

Even if margins stabilize, prospects for robust market performance are limited. With high P/E ratios and sluggish sales growth, investors may face below-average returns over the next decade, especially if economic growth continues to decelerate.