The Wealth Effect: How Soaring Stocks Complicate the Fed’s Inflation Efforts

With 62% of U.S. adults holding investments in corporate America, reducing consumer demand enough to curb inflation seems increasingly difficult.

Last week, U.S. stocks reached new all-time highs, enhancing the financial well-being of millions and complicating the Federal Reserve’s battle against inflation.

According to Gallup data released this month, 62% of U.S. adults have investments in the stock market through direct shares, mutual funds, 401(k)s, or individual retirement accounts. This level is consistent with 2023 and mirrors the period from 1998 to 2008.

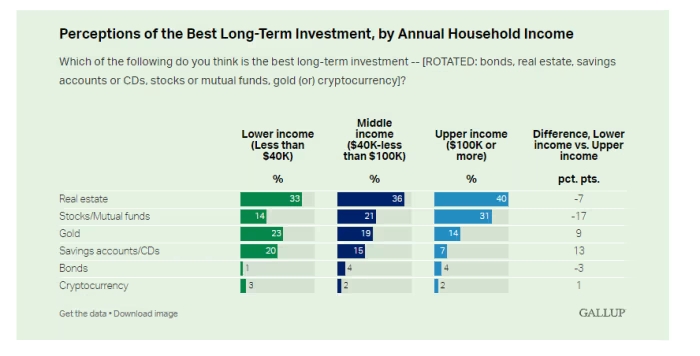

Even low-income households, earning less than $40,000 annually, and middle-income households, earning up to $100,000, are participating in the stock market: 25% and 65%, respectively, based on Gallup’s survey conducted from April 1-22.

May’s rally in equities, which saw the Nasdaq Composite reach 16,920.79 and the S&P 500 hit 5,321.41, makes it challenging to foresee a sufficient decrease in consumer demand to lower inflation.

By Friday, the Nasdaq Composite, S&P 500, and Dow Jones Industrial Average had risen by 8.1%, 5.3%, and 3.3% for the month of May.

The coming week will provide fresh data on consumer attitudes and U.S. inflation. The Conference Board’s consumer-confidence reading for May on Tuesday and the personal consumption expenditures price index on Friday will be key indicators.

A strong labor market and continued consumer spending are helping the U.S. avoid a recession, but record-high stock prices may be fueling a negative feedback loop on inflation. This disconnect between perceived wealth and economic sentiment is evident in a poll by Harris for the Guardian, which found many believe the economy is in a recession and that the S&P 500 is down for the year, though it isn’t.

The wealth effect, where people spend more as their wealth increases even if their income doesn’t, may be at play. Analysts like Torsten Slok of Apollo Global Management link the Fed’s 2024 rate cuts to consumer spending driving higher-than-expected inflation in the first quarter.

In December, Charlie McElligott of Nomura Securities International warned that the Fed’s dovish pivot in late 2023 might boost “animal spirits” and ease financial conditions, making it harder to control inflation.

First-quarter inflation readings were hotter than expected. Despite three months of minimal progress towards the 2% target, Fed Chairman Jerome Powell indicated on May 1 a low chance of future rate hikes, sparking a stock rally.

Brent Schutte of Northwestern Mutual Wealth Management noted that the wealth effect is keeping inflation elevated and that the stock market is complicating the last mile of inflation reduction.

The question now is whether the “risk-on” appetite, driven by tech-driven productivity hopes and solid corporate earnings, can coexist with inflation above 2%.

Minutes from the Fed’s April 30-May 1 meeting showed some officials’ willingness to raise rates again if necessary, noting that gains from the stock market and rising housing prices might not be enough to curb demand and inflation.

S&P surveys last Thursday indicated that inflation remains a concern for businesses, contributing to a 605.78-point drop in the Dow Jones Industrial Average, its worst one-day decline in over a year. However, stock indexes rebounded on Friday despite consumer sentiment darkening due to inflation worries.

Michael Reynolds of Glenmede suggested that while the Fed might still need to hike rates, inflation will likely remain above 2%. A stock market correction may be needed given high investor hopes for lower borrowing costs.

Glenmede has adjusted its view from underweight to neutral on equities, balancing macro risks and advising clients to avoid major portfolio shifts ahead of the November election.